The deal for Fiat to partner with Chrysler is done. I think that everybody - Fiat, Chrysler employees, the UAW VEBA, the USG, the remaining dealers, and even the whiny creditors - got more with this agreement than they would have if Chrysler had been liquidated. The biggest losers are whoever had planned to cherry-pick things like the Jeep brand or the minivan franchise or various other bits of IP out of the wreckage.

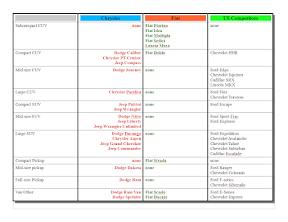

What I haven't seen published is a side by side comparison of Fiat and Chrysler. A lot of people have said it is a good match, and a quick glance at the product portfolio suggests they are right. But shouldn't we do more thank kick the tires? (Sorry, couldn't resist.)

Here's a rough comparison of the companies. While the automotive divisions are about the same size, FIAT as a whole is a much larger conglomerate. So even though it contributed to no cash to this deal, Fiat should be able to bring a lot of resources when needed in the future.

Here's a rough comparison of the companies. While the automotive divisions are about the same size, FIAT as a whole is a much larger conglomerate. So even though it contributed to no cash to this deal, Fiat should be able to bring a lot of resources when needed in the future.

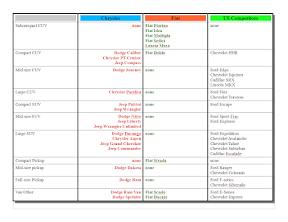

At first glance the car lineups of the two companies don't overlap much, which is good. But closer inspection reveals a major hole in the D-car segment. The Sebring/Avenger sedans are awful, the Croma is a wagon-like thingy that doesn't sell very well, and while the 159 is nice, the platform is probably too costly to adapt to lower market segments. The Croma has the added problem of being based on the GM Epsilon platform, which underpins the Malibu and a bunch of other GM vehicles. I assume the Fiat has the rights to the IP, but the question remains as to whether it can successfully improve this platform as much as it's larger rivals are sure to. This hole is a big problem because in the US the mid-size segment is the best selling among cars.

At first glance the car lineups of the two companies don't overlap much, which is good. But closer inspection reveals a major hole in the D-car segment. The Sebring/Avenger sedans are awful, the Croma is a wagon-like thingy that doesn't sell very well, and while the 159 is nice, the platform is probably too costly to adapt to lower market segments. The Croma has the added problem of being based on the GM Epsilon platform, which underpins the Malibu and a bunch of other GM vehicles. I assume the Fiat has the rights to the IP, but the question remains as to whether it can successfully improve this platform as much as it's larger rivals are sure to. This hole is a big problem because in the US the mid-size segment is the best selling among cars.

There are additional problems. For instance, Fiat's C-segment cars are all hatchbacks, which aren't very popular in the US compared to sedans. Most companies have multiple body styles in that segment (3 and 5 door hatchbacks, sedan, wagon, coupe), even if they aren't all sold in the US. Fiat's B-segment cars are also all hatchbacks, but body dimensions in this class make any other shape of low utility. Another problem is the lack of smaller sports cars. The Sebring convertible still exists for now, and sells great to rental fleets and middle-aged women. But currently Fiat has nothing to compete with vehicles like the Miata or Solstice/Sky. Chrysler's E-segment cars are about to be refreshed, and the platform could be used by Alfa to fill the hole in that part of it's lineup. But they are heavy and thirsty, and thus could suffer from another gas price spike. On the other side, the Thesis is an oddball I can't find much information about, and the Quattroporte is both tremendous and tremendously expensive.

In the so-called "light truck" arena the combination looks good at first as well. (I should note that the line between CUV and SUV has become rather blurred, and some of the categorizations I've made are debatable. Also, I put minivans on the cars page for space reasons.) Fiat has a very odd mix of vehicles piled up at the small end of the CUV market. I don't think any of those would sell much in the USA. Unfortunately, the Caliber/Compass twins aren't all that good either. The Journey is a little better, and potentially could be re-used in Europe. Of the more pure SUVs, most of the models just aren't suitable to either European tastes or European roads. This includes the Pacifica (which has been scheduled for cancellation anyway), the Durango/Aspen pair, the Nitro/Liberty pair, and the Commander (also scheduled for cancellation). The Wrangler and the Grand Cherokee do have potential to sell in Europe and elsewhere. The pickups don't. Fiat already has a number of commercial vehicles, so the Mercedes-derived Sprinter and old-school Ram Van are likely to die soon.

In the so-called "light truck" arena the combination looks good at first as well. (I should note that the line between CUV and SUV has become rather blurred, and some of the categorizations I've made are debatable. Also, I put minivans on the cars page for space reasons.) Fiat has a very odd mix of vehicles piled up at the small end of the CUV market. I don't think any of those would sell much in the USA. Unfortunately, the Caliber/Compass twins aren't all that good either. The Journey is a little better, and potentially could be re-used in Europe. Of the more pure SUVs, most of the models just aren't suitable to either European tastes or European roads. This includes the Pacifica (which has been scheduled for cancellation anyway), the Durango/Aspen pair, the Nitro/Liberty pair, and the Commander (also scheduled for cancellation). The Wrangler and the Grand Cherokee do have potential to sell in Europe and elsewhere. The pickups don't. Fiat already has a number of commercial vehicles, so the Mercedes-derived Sprinter and old-school Ram Van are likely to die soon.

That leaves the iconic (but scheduled for cancellation) PT Cruiser, and the mini-vans, where the sizes are close but not quite the same. The Ulysse/Phedra pair are about the size of the Chrysler minivans from two product cycles back. The Grand Caravan/T&C pair still sell well, but the market isn't as popular these days. Honda, Hyundai/Kia, and Toyota have taken market share (as well as driven Ford and GM out of the category) Here the combined companies would be best served to continue to the Chrysler platform as-is, but slightly downsize the Fiat platform. The PT Cruiser is very dated, but still sells. I think the plan is to build the US-market 500 in Toluca plant, so there is no chance of the PTC continuing.

So, to summarize, the overlap is minimal both in terms of existing product and sales areas. However, there are major product holes that need to be filled very soon. I still have doubts as to whether Chrysler can survive long enough to get the small Fiat models in the showroom and selling well. I also have doubts as to whether the combined company can make a competitive mass-market D-segment car because it has been a chronic problem for both companies. Arguably Fiat has never had a good car in this class, and while the original "cloud cars" were competitive when they were first brought out, that was over 15 years ago now. Chrysler - under Mercedes' lousy management - let the original platform fester, and then was forced to work with a half-baked platform donated by Mitsubishi before Mercedes gave up its ownership in the Japanese firm.

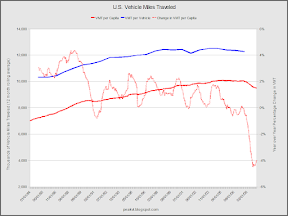

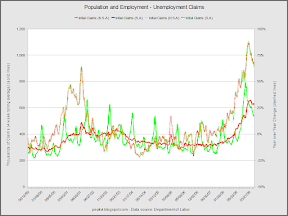

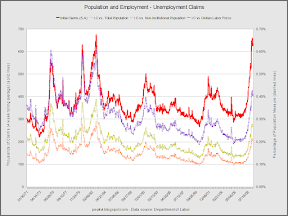

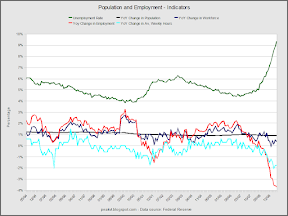

It will take several months to see how the new combination is working. The extended shutdown at Chrysler has cleared a lot of inventory which should help the remaining dealers. But the car market is still much smaller than it was a year or two ago, so it might be that the remaining Chrysler plants can't be run profitably.