So I was wondering what it would take to pay off the external debt. Good grief, am I weird.

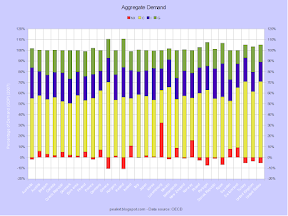

Here's the breakdown of the economy for the past 78 years. NX is net exports, which has been notably negative of late. I is investment, both business and residential. G is government purchases and investment. And C is the almighty consumer's consumption. As you can see, when exports are negative the total of everything else pops over 100%. That's because the following equation holds:

Here's the breakdown of the economy for the past 78 years. NX is net exports, which has been notably negative of late. I is investment, both business and residential. G is government purchases and investment. And C is the almighty consumer's consumption. As you can see, when exports are negative the total of everything else pops over 100%. That's because the following equation holds: AD = C + I + G + NX. This can also be written as: AD = C + I + G + (X - Im). An example would be: $10T = $7T + $2T + $2T - $1T. That's the US. A mature $10T economy should look like this: $10T = $5T + $2T + $2T + $1T. That's Germany or Japan, which are exporters and net investors overseas. Theoretically, an emerging economy should look like this: $10T = $6T + $3T + $2T - $1T. That's a country which is investing heavily, sucking in capital goods in the process. But the world has gone crazy, and the East Asian exporting countries resemble this: $10T = $4T + $3T + $2T + $1T. They have been both consuming little domestically and investing heavily, thanks to Americans' lust for stuff.

In this graph you can see how consumption has crept up to 70% of GDP. That's about 6% over the long-term average. America's profligacy has added up over time, with the total standing at about $2.9T. The dollar amount represents about 19% of GDP, so running a 1% trade surplus would "pay off" the debt in 19 years (which waves away several issues - but we're talking economics, so I am free to do that). Of course, the debt wouldn't literally be paid off like a loan, since it is not owed to a specific entity or entities by any one entity in the United States. Instead, the net investment position would go down to zero as cash from the trade surplus found its way back to the rest of the world as capital.

In this graph you can see how consumption has crept up to 70% of GDP. That's about 6% over the long-term average. America's profligacy has added up over time, with the total standing at about $2.9T. The dollar amount represents about 19% of GDP, so running a 1% trade surplus would "pay off" the debt in 19 years (which waves away several issues - but we're talking economics, so I am free to do that). Of course, the debt wouldn't literally be paid off like a loan, since it is not owed to a specific entity or entities by any one entity in the United States. Instead, the net investment position would go down to zero as cash from the trade surplus found its way back to the rest of the world as capital.

Here's one possible scenario. The details are SWAGs, but the medium-term future will definitely see an overall downward trend in consumption as the boomers age and demand more medical services, causing taxes to go up. Consumption below 60% would be quite a change from recent levels. The first charts shows there have been only 4 years with levels so low - all during WWII. Using big round numbers, in the near future the US will have to go from this:

Here's one possible scenario. The details are SWAGs, but the medium-term future will definitely see an overall downward trend in consumption as the boomers age and demand more medical services, causing taxes to go up. Consumption below 60% would be quite a change from recent levels. The first charts shows there have been only 4 years with levels so low - all during WWII. Using big round numbers, in the near future the US will have to go from this: $14T = $10T + $2T + $3T - $1T to this: $14T = $8T + $2T + $3T + $1T. Who volunteers to spend 20% less?

Of course, we don't really have to "pay off" the external debt - we could just whittle it down with inflation and create a different set of problems.

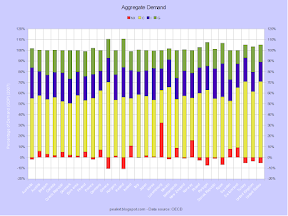

Update: What's a day without an international comparison? (Updated update: Swapped a column by mistake. I've updated the text to reflect that.)

As you can see, America is in some illustrious company: Iceland - exploded, Greece - riots, Spain - has housing bubble that makes America's look like a piker (percentage-wise), Portugal - (can't think of slam here), Turkey - frequent IMF recipient, and the UK - idiots who do whatever America does. Oh, and France. Turkey manages to edge America out by 0.01pp as the consumption champs. Sweden leads (or trails) in government demand while Mexico is at the other end. Spain leads the investment category with Germany as the laggard. (I'm surprised by the latter.) Luxembourg and Iceland are a micro-states (in terms of population), so their numbers can be thrown out. Note that the Euro-area average for consumption is almost 15pp below that of the U.S. Clearly people in other countries can survive on much less consumption than Americans are accustomed to.

As you can see, America is in some illustrious company: Iceland - exploded, Greece - riots, Spain - has housing bubble that makes America's look like a piker (percentage-wise), Portugal - (can't think of slam here), Turkey - frequent IMF recipient, and the UK - idiots who do whatever America does. Oh, and France. Turkey manages to edge America out by 0.01pp as the consumption champs. Sweden leads (or trails) in government demand while Mexico is at the other end. Spain leads the investment category with Germany as the laggard. (I'm surprised by the latter.) Luxembourg and Iceland are a micro-states (in terms of population), so their numbers can be thrown out. Note that the Euro-area average for consumption is almost 15pp below that of the U.S. Clearly people in other countries can survive on much less consumption than Americans are accustomed to.

No comments:

Post a Comment