GM is out of bankruptcy in a shockingly short amount of time, like Chrysler. That the transition went so fast is good, though I foresee lawsuits of varying merit following the new GM for a while.

Unlike the Chrysler-Fiat alliance, GM did have a lot of product overlap to shed in North America during bankruptcy. And I don't think management fully eliminated it. There is almost complete duplication between the Chevy truck lineup and the GMC lineup, especially since GMC killed their two larger commercial truck platforms. Chevy and Caddy occupy different market segments, but what is the role of Buick? American luxury? Huh? The marketing weenies have their work cut out for them in this regard. The decision to keep Buick may have more to do with its strength in China than its future prospects in North America.

As for the dead brands, killing HUMMER and Saab were no-brainers: they were both close to death already. Saturn, too, has had a tremendous decline in sales over the past two years. But the basic concept of the brand - a limited range of competent cars sold in a low-pressure atmosphere - was ruined several years ago by bureaucratic infighting at GM headquarters. It became just another engineered badge. Pontiac had been an engineered badge for years, supposedly with more a more sporty, performance oriented lineup of cars than Chevy. But Chevy offered performance versions of its vehicles, and GM's ultimate performance vehicle remained with the brand. In the end, Saturn, Pontiac, and Chevy all competed for roughly the same customers at the lower end of the market. Chevy was the logical one to keep.

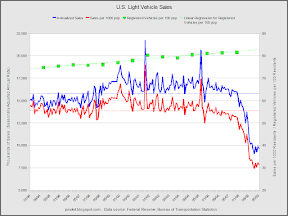

For reference, here are the June sales numbers for GM from 2009 and 2007:

- Buick - 8601 (16519)

- Cadillac - 8473 (16647)

- Chevrolet - 106712 (186474)

- GMC - 19668 (40457)

- HUMMER - 1078 (5093)

- Pontiac - 23740 (33683)

- Saab - 779 (4361)

- Saturn - 7520 (21686)

Overseas (meaning outside the US+CA market) GM is keeping everything but Saab, which will be bailed out by the Swedish government via Koenigsegg. GM will retain a minority ownership in Opel and Vauxhall under a tentative agreement with Magna. The remaining operations are GM Daewoo (which are badged as Chevrolets in most of the world), Holden (AU-NZ brand with one home-grown platform), GM China (Buick, Caddy, and others), and Wuling (a joint venture with CN-only platforms).