The NY Times reports today that the Japanese government is about to declare a significant area around the Fukushima Dai-ichi Nuclear Power Plant as uninhabitable for the foreseeable future. It's not going to buy the properties in the no-go zone, however. The Japanese government will rent them instead. That's a good way of putting off the day of reckoning, which would cost a pretty penny. (I'm likely off with all of these numbers but the scale is what is important here.) If we use a price of $200,000 per home, every 5,000 homes condemned would cost about $1 billion to buy. That's not much compared to Japan's GDP, but renting would only cost about $90 million per year if the monthly rent is $1500. That adds up quickly, of course, but in 11 or 13 years, when the rental costs surpass the cost of outright purchase plus interest, none of the politicians in charge will be around.

I think what is likely to happen in somewhat cramped Japan is that the worst affected areas will be bought in 5 or 10 years, partially cleaned, and then converted into large industrial districts. The population of Japan is already declining, so the housing units won't be missed that much (from an economic perspective). In the meantime, tens of thousands of people will be left in limbo, not able to sell and move on, or go home. And so the crisis will continue for years, even after the reactors are brought under control.

Monday, August 22, 2011

Wednesday, August 17, 2011

Smoke Two Joints

phhhhhhhhhhHHHHHHtt.... wah? O hai.

Actually, I don't smoke anything, or even drink these days. But this writeup at Wired of some fascinating research makes me think I should start ... if it were legal. It turns out not only does using pot not make you permanently stupid, it actually makes you smarter in one particular way when you're high - word association. It's a little more complicated than that, of course. And there is some reduction in short-term verbal memory among current heavy users. But overall, this is another piece of evidence that supports the decriminalization of marijuana. The harm caused by criminalization continues to far outweigh the harm caused by the drug itself.

On a strictly anecdotal basis, I've always thought the dumb stoner/hippy affect was a sub-cultural artifact. The whole "oh, wow, man" attitude may be induced by getting high, but its carryover to the rest of people's waking lives was a learned trait. Fortunately the sub-culture has mostly gone away, especially now that The Dead are dead.

Actually, I don't smoke anything, or even drink these days. But this writeup at Wired of some fascinating research makes me think I should start ... if it were legal. It turns out not only does using pot not make you permanently stupid, it actually makes you smarter in one particular way when you're high - word association. It's a little more complicated than that, of course. And there is some reduction in short-term verbal memory among current heavy users. But overall, this is another piece of evidence that supports the decriminalization of marijuana. The harm caused by criminalization continues to far outweigh the harm caused by the drug itself.

On a strictly anecdotal basis, I've always thought the dumb stoner/hippy affect was a sub-cultural artifact. The whole "oh, wow, man" attitude may be induced by getting high, but its carryover to the rest of people's waking lives was a learned trait. Fortunately the sub-culture has mostly gone away, especially now that The Dead are dead.

Wednesday, August 10, 2011

Is Our Central Bankers Learning?

Twice in the past three days, important central banks have actually done something slightly positive. Sunday night it was the European Central Bank deciding to intervene in the Italian and Spanish sub-sovereign bond markets. Yesterday it was the Federal Reserve setting expectations on how long it plans to keep its current low-interest rate policy. The ECB's intervention has worked, at least temporarily, as the interest rate premiums for both countries vs. Germany have dropped sharply (divide the numbers by 100 to get real world units). The Fed's statement was aimed at general sentiment, not any specific index, so it's a little early to say if it worked.

In both cases, however, the gap between what is being done and what should be done is still far too wide. Hopefully, these two actions were just first steps towards more sensible policies.

Update: 2011.08.11: Yves Smith talks about the central bank actions.

In both cases, however, the gap between what is being done and what should be done is still far too wide. Hopefully, these two actions were just first steps towards more sensible policies.

Update: 2011.08.11: Yves Smith talks about the central bank actions.

Tuesday, August 9, 2011

What Goes Down Must Come Up?

Thank goodness our markets are so eminently rational.

Here's an annotated chart of today's market movements. In 30 minutes, starting at 2:15 when the Federal Reserve Open Market Committee released its latest meeting statement, the DJI went up by 77 points, then down 227 points, then up 146 points, and finally down 285 points. In the 75 minutes from 2:45 to the close (the computers took about 7 minutes to spit out the final number) the DJI increased 624 points, or about 5.8% from the intra-day low.

Is there any possible justification for this kind of herd behavior?

Here's an annotated chart of today's market movements. In 30 minutes, starting at 2:15 when the Federal Reserve Open Market Committee released its latest meeting statement, the DJI went up by 77 points, then down 227 points, then up 146 points, and finally down 285 points. In the 75 minutes from 2:45 to the close (the computers took about 7 minutes to spit out the final number) the DJI increased 624 points, or about 5.8% from the intra-day low.

Monday, August 8, 2011

Friday, August 5, 2011

Up, Down, Turn Around

I want to thank S&P for providing me with this evening's quota of humor. If you're going to do something as momentous as downgrading the U.S. Government's credit rating, at least get the numbers right first. And after embarrassing itself so thoroughly, I suspect S&P went through with the change mostly so it could distract everybody from its foolishness.

On the sober, serious side, Salmon has some good comments on the situation. The US remains the richest country in the world, with very low tax rates compared with other industrialized countries. But the political risk of default isvery, very real. Heck, if "the deal" had been bad enough, I would have been willing to bring on the default. As it turned out, the deal is merely mildly counterproductive - at least until the new and improved Catfood Commission II reports in. But the entire crisis was purposely contrived to extract spending cuts that the Teahadists wouldn't have been able to negotiate with the Senate and White House. The best analogy I can come up with is a doctor holding a pneumonia patient hostage by threatening to shoot the patient unless the doctor is allowed to amputate a leg. The US is suffering through a huge jobs crisis, but the Teahadists want to cut government spending, and they were willing shut the US government down and ruin its credit rating in order to get what they wanted. Fortunately (or not), all they got was a promise to consider amputation in a few months.

BREAKING! MUST CREDIT... just about everyone. Okay, here's some text from S&P's release:

Added: Krugman weighs in with a somewhat harsher view of S&P than Salmon.

Added: Drum thinks the risk of actual default was and is remote. I used to think that, but I no longer believe that the Teahadists are under anybody's control.

Added: Here's a good post on why the practical effects of a downgrade - even by all three agencies - are likely to be minimal. I largely agree, though I would qualify it with "in the short term" more explicitly. Another qualifier that I would add is "provided nothing bad happens elsewhere." A breakup of the Euro would send investors piling into any US asset, especially Treasuries, driving down yields sharply.

On the sober, serious side, Salmon has some good comments on the situation. The US remains the richest country in the world, with very low tax rates compared with other industrialized countries. But the political risk of default is

BREAKING! MUST CREDIT... just about everyone. Okay, here's some text from S&P's release:

We lowered our long-term rating on the U.S. because we believe that the prolonged controversy over raising the statutory debt ceiling and the related fiscal policy debate indicate that further near-term progress containing the growth in public spending, especially on entitlements, or on reaching an agreement on raising revenues is less likely than we previously assumed and will remain a contentious and fitful process.Heh-indeedy. Unfortunately, the rest is worse. But that's not surprising, as the way S&P inserted itself in the debate to begin with showed that it was clearly on one side. The release as whole is basically a continuation of their pressure to act in a certain way.

Added: Krugman weighs in with a somewhat harsher view of S&P than Salmon.

Added: Drum thinks the risk of actual default was and is remote. I used to think that, but I no longer believe that the Teahadists are under anybody's control.

Added: Here's a good post on why the practical effects of a downgrade - even by all three agencies - are likely to be minimal. I largely agree, though I would qualify it with "in the short term" more explicitly. Another qualifier that I would add is "provided nothing bad happens elsewhere." A breakup of the Euro would send investors piling into any US asset, especially Treasuries, driving down yields sharply.

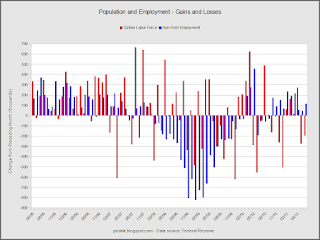

How's That Working For You: July 2011 Edition

Here's the latest in another chart series that I abandoned for a while.

The recession is pretty obvious here.

I think the data speaks for itself.

And here.

The unemployment rate is staying high instead of declining from a peak as it did in 1981.

Next are zoomed versions of the previous two graphs

Population growth has slipped below 1%.

The labor force data has become very noisy since the beginning of the pre-recession in early 2007. That's when people started experiencing that Wile E. Coyote moment and growth slowed.

Thursday, August 4, 2011

She's Got a Trichet to Ride

Megadiving in the markets today. Nobody knows for sure what fears live in the hearts of market makers, but today it seems to be goings-on in Yurp, where the German-Italian bond spread continues to balloon. The ECB's policies have been disastrous, predictably.

The most interesting proposal to resolve the crisis is this one from Ambrose Evans-Pritchard. Generally I find AE-P to be a bit of a breathless blowhard, but at first glance the idea that Germany should withdraw from the Euro is quite intriguing. Germany, along with a few others in concert, are more likely to be able to pull off a orderly withdrawal because they are more likely to be able to keep the whole thing secret. Discretion during any unplanned currency switchover is very important, because public knowledge is likely to trigger a bank run. (The situation is different if the changeover is announced years in advance, as happened with the formation of the Euro.) The new currency - lets call it the nordmark - would appreciate against the rump Euro, allowing the South European countries to regain competitiveness and grown their economies without suffering through years of deflation first..

As always, reality is likely to be a lot more complicated, so such a move may end up making everything worse compared to organizing bailouts and haircuts and other such things within the existing currency union. Or individual countries in the so-called PIIGS quintet may be better off going their own way. Dunno. But like the auto bankruptcies here in America, whatever happens should happen in an organized manner, because we know that chaotic failure will produce the worst outcome. And right now Germany and its proxy the ECB are steering the Eurobus towards a cliff.

The most interesting proposal to resolve the crisis is this one from Ambrose Evans-Pritchard. Generally I find AE-P to be a bit of a breathless blowhard, but at first glance the idea that Germany should withdraw from the Euro is quite intriguing. Germany, along with a few others in concert, are more likely to be able to pull off a orderly withdrawal because they are more likely to be able to keep the whole thing secret. Discretion during any unplanned currency switchover is very important, because public knowledge is likely to trigger a bank run. (The situation is different if the changeover is announced years in advance, as happened with the formation of the Euro.) The new currency - lets call it the nordmark - would appreciate against the rump Euro, allowing the South European countries to regain competitiveness and grown their economies without suffering through years of deflation first..

As always, reality is likely to be a lot more complicated, so such a move may end up making everything worse compared to organizing bailouts and haircuts and other such things within the existing currency union. Or individual countries in the so-called PIIGS quintet may be better off going their own way. Dunno. But like the auto bankruptcies here in America, whatever happens should happen in an organized manner, because we know that chaotic failure will produce the worst outcome. And right now Germany and its proxy the ECB are steering the Eurobus towards a cliff.

Tuesday, August 2, 2011

Under the Hood: July 2011 Edition

Sales are up from last month's dismal showing. I am going to wait until next month to see if the Japanese companies have recovered.

There's been several changes to the brands graph since the last time I posted one. Hummer, Mercury, Pontiac, and Saturn are dead. (Isuzu has been dead for a while but lives on in my data.) Ram has been broken out from Dodge as a separate brand. Toyota reported Scion as a separate brand for a few months, but seems to have gone back to combining the data for both brands. Jaguar and Land Rover are reporting sales again. And Fiat makes it's first appearance.

There's been several changes to the brands graph since the last time I posted one. Hummer, Mercury, Pontiac, and Saturn are dead. (Isuzu has been dead for a while but lives on in my data.) Ram has been broken out from Dodge as a separate brand. Toyota reported Scion as a separate brand for a few months, but seems to have gone back to combining the data for both brands. Jaguar and Land Rover are reporting sales again. And Fiat makes it's first appearance.

Monday, August 1, 2011

Shit Sandwich, or Just Plain Shit?

There's very little positive to say about the deal reach today, except that it's better than default, and it's better than other possible deals. The details floating about earlier in the day were skimpy, but awful. The final deal seems to be better, though there are conflicting versions. It's not over yet, however, as one or both House caucuses might reject the deal.

Given a choice between shit or a shit sandwich, I think most people would take the latter. But it's not really something anyone would celebrate. Similarly, default is a worse option than the deal, but the deal is still bad in the absolute. We need more deficit spending now, not less. The economy is very weak, and the longer it stays weak, the bigger our long-term problems will become. We shouldn't be making big cuts to domestic discretionary programs, because they are already insufficient. We should be making more cuts the national security budget, and moving that money over to the domestic side. And so on.

It's crazy that we are even having this discussion.

Update 2011/08/01: Also, not a grand bargain, but no guarantees that the hostage-taking won't happen again with the 2012 and 2013 budgets. And some of the language in the spin from the White House is horrid.

Given a choice between shit or a shit sandwich, I think most people would take the latter. But it's not really something anyone would celebrate. Similarly, default is a worse option than the deal, but the deal is still bad in the absolute. We need more deficit spending now, not less. The economy is very weak, and the longer it stays weak, the bigger our long-term problems will become. We shouldn't be making big cuts to domestic discretionary programs, because they are already insufficient. We should be making more cuts the national security budget, and moving that money over to the domestic side. And so on.

It's crazy that we are even having this discussion.

Update 2011/08/01: Also, not a grand bargain, but no guarantees that the hostage-taking won't happen again with the 2012 and 2013 budgets. And some of the language in the spin from the White House is horrid.

Subscribe to:

Posts (Atom)