While there seems to be a temporary lull in Eurozone action, I

don't think the developments on Friday and over the weekend amount to a turning point. Installing "technocratic" elites doesn't make a lot of sense, because it was unaccountable technocrats who created the mess in the first place. That the specific technocrats have links to Goldman Sachs, which arranged the accounting fraud

that allowed to Greece to enter the Eurozone in the first place,

doesn't inspire confidence, either. Stergios Skaperdas has written

another op-ed on Greece leaving the Euro. I

wish Greek politicians would read it but, like national-level politicians

everywhere, they seem to be tightly encased in their own little bubble. Even when they make noises about the austerity being imposed on the country, it is to position themselves in the next election, not because they have a better alternative.

The most immediate impact of the change of Prime Minister in Italy has done is given everyone a chance to write about how awful Silvio Berlusconi has been for Italy. It's not a new topic; people have been writing about Italy's Murdoch+Buffett for years. A lot of Italy's "structural" problems would have existed if he had stayed out of politics. And some of the uniquely Italian problems have been around for decades. But having as Prime Minister someone who was arguably in politics to keep himself exempt from prosecution as much as anything else has taken amoral familism to a new level.

So while having Silvio gone will improve Italy's long-term prospects, in the immediate future the problem is basically one of math. Unless bond rates come down, and the economy either grows or inflates (a.k.a. currency devaluation), Italy will probably join Greece in exiting the Eurozone. The problem is that the economy is unlikely to grow fast enough to convince bondholders to accept lower rates. And the ECB is still the ECB, so it's unlikely to help in one way or another. That has prompted more calls to end the common currency. Both a recession in Europe and a collapse of the Euro would affect the United States, something the country can't really afford on top of our own past and potential future stupidity.

Monday, November 14, 2011

Wednesday, November 9, 2011

Mio Dio, Cosa Hai Fatto, Silvio?

The ever-wise markets seem to have skipped ahead in their script by a few countries, because today the world woke up to find Italy on the verge of financial ruin. Or at least that's what everybody is saying the markets are saying. Unfortunately, as long as everyone believes it to be true, it's likely to come true.

I find it suspicious that right after the Greek mess has been "resolved" that the Italian crisis would suddenly come to a head. Shouldn't the agreement of the Greek parties to unite to screw the Greek people give everyone else at least a few weeks of relief? Apparently not. Nothing else about Italy's underlying financial condition, which isn't that bad, has changed since last week. But sharply increasing yields means that whenever Italy has to roll some debt, which most indebted countries do on a regular basis, it will have to pay substantially more. Thus the problem in Italy has become self-fulfilling.

The failure to resolve the crisis is mostly the European Central Bank's fault. It has basically refused to do the job of a proper central bank, which is to regulate the macro economy for the greater good. The origins of the crisis are much more structural, which quite a few people still don't understand. But rather than do the right thing and forgive gobs of debt, or exit the Euro themselves, the core Eurozone countries may be to be planning to kick the GIPS countries out. I can't see how that would be a good solution economically or politically. Not only would it create immense amounts of ill will in the region, it would still leave the GIPS countries with their external debt denominated in a foreign currency. That class of debt is the only justifiable reason for Greece not leaving the Euro that I can see, and forcing the issue on multiple countries at once couldn't possibly help.

If things do really unravel in Europe, which they haven't done quite yet, I think US markets won't entirely collapse due to flight-to-safety inflows. I could easily be wrong about that, though. But obviously a breakdown overseas would fall through to front-line jobs within weeks, and that would exacerbate what is already a crisis.

Update 2011-11-09: Italy's problems may very well be Silvio's fault.

Update 2011-11-10: Italy's bond sale was successful but at a rate that is a good deal higher than last year.

I find it suspicious that right after the Greek mess has been "resolved" that the Italian crisis would suddenly come to a head. Shouldn't the agreement of the Greek parties to unite to screw the Greek people give everyone else at least a few weeks of relief? Apparently not. Nothing else about Italy's underlying financial condition, which isn't that bad, has changed since last week. But sharply increasing yields means that whenever Italy has to roll some debt, which most indebted countries do on a regular basis, it will have to pay substantially more. Thus the problem in Italy has become self-fulfilling.

The failure to resolve the crisis is mostly the European Central Bank's fault. It has basically refused to do the job of a proper central bank, which is to regulate the macro economy for the greater good. The origins of the crisis are much more structural, which quite a few people still don't understand. But rather than do the right thing and forgive gobs of debt, or exit the Euro themselves, the core Eurozone countries may be to be planning to kick the GIPS countries out. I can't see how that would be a good solution economically or politically. Not only would it create immense amounts of ill will in the region, it would still leave the GIPS countries with their external debt denominated in a foreign currency. That class of debt is the only justifiable reason for Greece not leaving the Euro that I can see, and forcing the issue on multiple countries at once couldn't possibly help.

If things do really unravel in Europe, which they haven't done quite yet, I think US markets won't entirely collapse due to flight-to-safety inflows. I could easily be wrong about that, though. But obviously a breakdown overseas would fall through to front-line jobs within weeks, and that would exacerbate what is already a crisis.

Update 2011-11-09: Italy's problems may very well be Silvio's fault.

Update 2011-11-10: Italy's bond sale was successful but at a rate that is a good deal higher than last year.

Thursday, November 3, 2011

More Χάος

News is breaking on an hourly basis in Europe these days, with Greece still being the center of attention. The latest loop is the sudden appearance and disappearance of plans for a referendum on the bailout and austerity measures being put to the Greek people. It is quite likely that Papandreou was bluffing his fellow politicians into joining him in sharing the political pain, which he may have done successfully.

As I said over here, I just don't see how the situation can be sorted out while Greece still uses the Euro. I don't know how much adjustment of one kind or another is necessary to bring Greek labor costs down to where they are in line with the productivity* of its workers, but I suspect it is a lot. And by a lot, I mean 15-30%. Deflation by that amount implies that as long as Greece still uses the Euro, its citizens will, on average, have to take pay cuts of 15-30%. This would be painful but not devastating if individuals and businesses were basically debt-free. But that's not the case in Greece, though it must be said that they aren't close to being the most indebted. But debt doesn't automatically shrink when wages and prices deflate. In fact, the real burden goes up. And substantially greater real burdens means substantially more foreclosures, bankruptcies, and corporate bond defaults. That's why devaluation makes a lot more sense, and which would happen automatically in the markets if Greece still had its own currency - provided, of course, nobody is manipulating their currency.

So the mystery continues - why are Greek politicians pursuing such awful policies?

* - saying that Greeks are less productive doesn't mean they don't work long hours. It just means that for one or more reasons their output is less per hour.

As I said over here, I just don't see how the situation can be sorted out while Greece still uses the Euro. I don't know how much adjustment of one kind or another is necessary to bring Greek labor costs down to where they are in line with the productivity* of its workers, but I suspect it is a lot. And by a lot, I mean 15-30%. Deflation by that amount implies that as long as Greece still uses the Euro, its citizens will, on average, have to take pay cuts of 15-30%. This would be painful but not devastating if individuals and businesses were basically debt-free. But that's not the case in Greece, though it must be said that they aren't close to being the most indebted. But debt doesn't automatically shrink when wages and prices deflate. In fact, the real burden goes up. And substantially greater real burdens means substantially more foreclosures, bankruptcies, and corporate bond defaults. That's why devaluation makes a lot more sense, and which would happen automatically in the markets if Greece still had its own currency - provided, of course, nobody is manipulating their currency.

So the mystery continues - why are Greek politicians pursuing such awful policies?

* - saying that Greeks are less productive doesn't mean they don't work long hours. It just means that for one or more reasons their output is less per hour.

Sunday, October 30, 2011

Our Lousy Media

Consider this series of screenshots (via Shawn in comments):

There was an interesting report released this week.

But if you watched Fox, you wouldn't know.

To be fair and balanced, NPR isn't doing any better.

Nothing new here, either.

Elsewhere, there's a fair amount of chatter.

Why is this important, you wonder?

Because the end of the controversy isn't being reported like the beginning.

The false accusations against the University of East Anglia's Climate Research Unit were widely reported, even in less biased news organizations, despite the evidence being thin.

But the final proof that they were false, and that the observational record that underlies the theory of anthropogenic climate change is solid, is absent from the airwaves so far.

Controversy sells.

Denouement doesn't .

But by not reporting both equally, our media creates false impressions.

And it's one of the reasons our media sucks.

There was an interesting report released this week.

But if you watched Fox, you wouldn't know.

To be fair and balanced, NPR isn't doing any better.

Nothing new here, either.

Elsewhere, there's a fair amount of chatter.

Why is this important, you wonder?

Because the end of the controversy isn't being reported like the beginning.

The false accusations against the University of East Anglia's Climate Research Unit were widely reported, even in less biased news organizations, despite the evidence being thin.

Controversy sells.

Denouement doesn't .

But by not reporting both equally, our media creates false impressions.

And it's one of the reasons our media sucks.

Tuesday, October 25, 2011

No School like the New School

One of the perennial issues politicians and the media like to take up is How Our Failing Schools Are Failing. Oh noes! The problem is, it's not true. America remains, in aggregate, a well-educated country. The actual problem is that a subset of public primary and secondary schools are failing miserably, mainly those in poor areas where parents fail their own kids in ways that schools can't entirely fix. But it's useful to the agenda of the far right for them to say that public schools writ large are failing, and our lousy media dutifully repeats the charge.

Now, of course and obviously, even the parts of the public school system that are doing well can be improved. One of the ways I believe American schools can be improved is by changing the curriculum to better reflect today's society. I'm not sure how the six subject curriculum that middle and high schools have traditionally offered began, but the fact that the school day lasted roughly six hours suggests that it happened largely by default. And it really wasn't six subjects; it was four plus two. The big four were primary language (English in the US), math, social studies, and science. The two were health and physical education (through 10th grade) along with one and then two electives of whatever else students or parents or local school board wants. Sometimes it was a foreign language, sometimes arts, sometimes a second science, and so on. But having only one or two slots available for all the other things a student might learn just wasn't enough. Because of this, most high schools have moved to a seven period day so students have more opportunities for electives.

Seven periods still isn't enough, however. I don't say that simply because I think "one louder" would automatically be better. Instead, I believe that schools should teach a curriculum of eight subjects, all treated equally1 (at least through 10th grade), because there are eight subject groups that students need to learn. Those would be the first four listed above, plus health and physical education, a second language, the arts, and technology. Briefly, here's why each is important.

The second implication is that the school year would need to be extended. If the annual calendar was kept the same, dividing the day (virtually) into eight blocks instead of six would reduce the amount of time spent on each subject - unless the school day was made drastically longer. However, I don't see why the current standard of 9000 minutes (nominal) of instruction annually for each subject should be considered necessary or optimal. At the same time, if all other things are equal, less time spent on a subject means less learned about a subject. Increasing the school year by 20 days to 200 would keep the reduction in time to less than 10%, when combined with a slightly longer day. I think an expansion of the amount of real teaching time that would come from using a bell schedule with bigger blocks would make up for the rest.5

The third implication of moving to eight subjects, which follows from the previous two, is that more teachers would have to be hired. Assuming they get one free period per day, it would take about 11% more teachers for the same number of students. Teachers would also want a pay increase, because their annual classroom time would go up. Since teacher pay is their largest expense, school systems would see a big rise in costs. I think the extra spending would be worthwhile, because the changes leading to the increase would cause incomes to rise for everybody, especially at the lower end.

This is a graphical summary of the curriculum changes detailed above. (The specific class names aren't important for this post, so don't get hung up on them.) It also adds in two other issues not directly linked to expanding the curriculum. One is that the age where specific subject matter teaching starts should be decreased. I don't think there is any bright line on when that should happen, but I think it's definitely before 7th grade, which is the typical point in much of the US. Note that I'm not saying the eight subjects shouldn't be taught in lower primary, just that the point at which subjects are taught by subject-matter experts should be at a younger age than is now the case.

The other new issue is vocational education. Most of the time discussion of secondary education excludes everyone not on a college track, which amounted to 45% of the people who left high school in 2009. This includes dropouts, along with those who do graduate but don't attend either a two-year or four-year college right away.6 There are vocational programs for some students, but clearly it's not sufficient. And more vocational training is needed because a strictly academic model doesn't teach many skills that are immediately useful in the jobs that people with no experience and only a high-school education are likely to take.

However, increasing the number of students on a vocational track would have problems. The main one is the potential for both explicit and unintentional discrimination. I don't know of an easy, mechanical way of solving that issue, but it does exist and should be acknowledged. There would also be logistical issues due to the need for specialized teaching facilities for most vocations. The exact solution to that depends on the nature of the school district and the economy in the surrounding region, and I'm not going to try to address all of the potential arrangements here.

Regardless of who is placed in each one, the split between the academic and vocational tracks should start in the 11th grade. I think making the decision sooner would yield more poor outcomes, because students would have not had enough time to develop their interests and academic abilities. On the other hand, while pushing it back a year would be less bad, that would force non-academically inclined students to spend a year in classes that they won't really benefit from. Academic classes wouldn't be completely eliminated from the vocational track in this model, however. Even after 10th grade, there are still some subjects that every student should take, and that can't be taught to younger students because of complexity.

None the changes I propose above are radical, though taken together they are significant. A truly revolutionary change would be to end secondary education at age 16, and move students into a system of "colleges" similar to what Québec has. The American junior colleges (aka community colleges) aren't quite the same, as many of the programs they offer replicate the first two years of a four-year degree. In Québec, attending a college is a prerequisite for entering a university, but baccalaureate programs are typically only three years long. The four-level system has some merits, but at this point I don't see them as being so great that they would be worth disrupting the current education system to the degree that would be necessary to implement the new third layer.

Unfortunately, my proposal won't be considered, and not only because I'm just some blogger on the internet that nobody reads. As in a lot of other policy areas, the current discussion about schools is just irrational. Not only is the very real problem of educating poor students not being addressed, we're instead talking about how teachers' unions are supposedly ruining everything. Until we actually talk about the actual problems the country faces, we'll never make the changes we really need to make.

1. Potentially schools could offer a curriculum of eight subjects with unequal treatment, but that would make scheduling much harder. It would also put the less emphasized subjects at greater risk of being cut completely for budgetary reasons.

2. Language instruction is a touchy issue in many countries, especially where there are long-established minority language regions. The political outcome is usually either to teach the regional language as a second language, or to teach the full curriculum in the regional language. In the US, where there are a lot of students who are recent immigrants, bilingual education in all of the home languages would be a logistical problem. The solution has been to give extra English language instruction for a couple of years, which often isn't enough for older students.

3. Specific classes aren't too important for this post, but I firmly believe that both statistics and accounting should be taught in high school, and to non-technical students they would be much more useful than advanced abstract math such as calculus. Adding statistics and accounting means every student would have at least one math classes every year until they graduate.

4. An example of a four-class day would be: 4x85 minutes of classes, plus 3x5 minutes for breaks, plus 30 minutes for lunch, plus 5 minutes for home room, for a total of 390 minutes. An example of an eight-class day would be: 8x40 minutes of classes, plus 7x5 minutes for breaks, plus 30 minutes for lunch, plus 5 minutes for home room, for a total of 390 minutes. An example of a traditional day would be: 6x50 minutes of classes, plus 5x5 minutes for breaks, plus 30 minutes for lunch, plus 5 minutes for home room, for a total of 360 minutes.

5. The percentage depends which of the two schedules is used. The 1+4 system yields 210 minutes per week per class (40+85+85), and the A/B system yields (on average) 212.5 minutes per week per class (85+85+85/2). Multiplying those counts by 40, then dividing by 9000 returns 93.3% and 94.4% of the traditional arrangement of 5 periods of 50 minutes per week per class for 36 weeks.

6. Cumulative enrollment of each annual cohort goes up over time to about 60% because some people delay attending college for various reasons, and others change their mind about attending after being in the workforce.

Now, of course and obviously, even the parts of the public school system that are doing well can be improved. One of the ways I believe American schools can be improved is by changing the curriculum to better reflect today's society. I'm not sure how the six subject curriculum that middle and high schools have traditionally offered began, but the fact that the school day lasted roughly six hours suggests that it happened largely by default. And it really wasn't six subjects; it was four plus two. The big four were primary language (English in the US), math, social studies, and science. The two were health and physical education (through 10th grade) along with one and then two electives of whatever else students or parents or local school board wants. Sometimes it was a foreign language, sometimes arts, sometimes a second science, and so on. But having only one or two slots available for all the other things a student might learn just wasn't enough. Because of this, most high schools have moved to a seven period day so students have more opportunities for electives.

Seven periods still isn't enough, however. I don't say that simply because I think "one louder" would automatically be better. Instead, I believe that schools should teach a curriculum of eight subjects, all treated equally1 (at least through 10th grade), because there are eight subject groups that students need to learn. Those would be the first four listed above, plus health and physical education, a second language, the arts, and technology. Briefly, here's why each is important.

- Primary language - A student should be proficient in the primary language of the country in which they live. This may or may not be the same as a student's home language, and in some places in some countries may be different from the local or regional language.2 Given the complexity of modern life, a person needs to be able to function in the language of most legal and economic transactions where they live, and anything less than proficiency puts them at a disadvantage. The literature of the primary languages is also a major component of a country's cultural heritage, and a student should be aware of it.

- Mathematics - Basic math is very useful in everyday life, and higher math is a necessary skill for large number of disciplines.3

- Physical sciences - The individual sciences and the scientific method in general are far better at describing the Earth we live on than anything else humans have thought of before. The sciences also provide the basis for many technologies and industries.

- Social studies - It is not possible to understand a society without having at least some understanding of how it developed. History teaches that. Other classes in the category are more focused on how societies function and compare today. Taken together they enable a person to understand the governance and politics of their country.

- Health and physical education - Children need to be active for the sake of their health, and because they usually have the urge to be. They also need to have a basic understanding of their own physiology in order to better maintain their health as they get older.

- Second language - Globalization means that people in one country often interact with those in or from another, and knowing a second language enables a person to interact on more equal terms with people with at least one foreign country. Minor benefits of a second language shown by some studies are improvement in first language learning, and in general cognitive ability.

- Technology - Humans use a variety of technologies, both low and high, in their everyday life. Everybody should have a basic understanding of things like how oil is refined, a house is constructed, electricity is generated, a computer is programmed, and so on. Having a general understanding enables a person to better interact with the technologies and make decisions about them.

- Fine arts - The arts are usually neglected once a student is ready to do something more than paint with their fingers or play a triangle. But because visual arts and music are important parts of a country's culture, and many people derive a great amount of pleasure in taking part in them, they should be taught as much any other subject.

The second implication is that the school year would need to be extended. If the annual calendar was kept the same, dividing the day (virtually) into eight blocks instead of six would reduce the amount of time spent on each subject - unless the school day was made drastically longer. However, I don't see why the current standard of 9000 minutes (nominal) of instruction annually for each subject should be considered necessary or optimal. At the same time, if all other things are equal, less time spent on a subject means less learned about a subject. Increasing the school year by 20 days to 200 would keep the reduction in time to less than 10%, when combined with a slightly longer day. I think an expansion of the amount of real teaching time that would come from using a bell schedule with bigger blocks would make up for the rest.5

The third implication of moving to eight subjects, which follows from the previous two, is that more teachers would have to be hired. Assuming they get one free period per day, it would take about 11% more teachers for the same number of students. Teachers would also want a pay increase, because their annual classroom time would go up. Since teacher pay is their largest expense, school systems would see a big rise in costs. I think the extra spending would be worthwhile, because the changes leading to the increase would cause incomes to rise for everybody, especially at the lower end.

This is a graphical summary of the curriculum changes detailed above. (The specific class names aren't important for this post, so don't get hung up on them.) It also adds in two other issues not directly linked to expanding the curriculum. One is that the age where specific subject matter teaching starts should be decreased. I don't think there is any bright line on when that should happen, but I think it's definitely before 7th grade, which is the typical point in much of the US. Note that I'm not saying the eight subjects shouldn't be taught in lower primary, just that the point at which subjects are taught by subject-matter experts should be at a younger age than is now the case.

The other new issue is vocational education. Most of the time discussion of secondary education excludes everyone not on a college track, which amounted to 45% of the people who left high school in 2009. This includes dropouts, along with those who do graduate but don't attend either a two-year or four-year college right away.6 There are vocational programs for some students, but clearly it's not sufficient. And more vocational training is needed because a strictly academic model doesn't teach many skills that are immediately useful in the jobs that people with no experience and only a high-school education are likely to take.

However, increasing the number of students on a vocational track would have problems. The main one is the potential for both explicit and unintentional discrimination. I don't know of an easy, mechanical way of solving that issue, but it does exist and should be acknowledged. There would also be logistical issues due to the need for specialized teaching facilities for most vocations. The exact solution to that depends on the nature of the school district and the economy in the surrounding region, and I'm not going to try to address all of the potential arrangements here.

Regardless of who is placed in each one, the split between the academic and vocational tracks should start in the 11th grade. I think making the decision sooner would yield more poor outcomes, because students would have not had enough time to develop their interests and academic abilities. On the other hand, while pushing it back a year would be less bad, that would force non-academically inclined students to spend a year in classes that they won't really benefit from. Academic classes wouldn't be completely eliminated from the vocational track in this model, however. Even after 10th grade, there are still some subjects that every student should take, and that can't be taught to younger students because of complexity.

None the changes I propose above are radical, though taken together they are significant. A truly revolutionary change would be to end secondary education at age 16, and move students into a system of "colleges" similar to what Québec has. The American junior colleges (aka community colleges) aren't quite the same, as many of the programs they offer replicate the first two years of a four-year degree. In Québec, attending a college is a prerequisite for entering a university, but baccalaureate programs are typically only three years long. The four-level system has some merits, but at this point I don't see them as being so great that they would be worth disrupting the current education system to the degree that would be necessary to implement the new third layer.

Unfortunately, my proposal won't be considered, and not only because I'm just some blogger on the internet that nobody reads. As in a lot of other policy areas, the current discussion about schools is just irrational. Not only is the very real problem of educating poor students not being addressed, we're instead talking about how teachers' unions are supposedly ruining everything. Until we actually talk about the actual problems the country faces, we'll never make the changes we really need to make.

1. Potentially schools could offer a curriculum of eight subjects with unequal treatment, but that would make scheduling much harder. It would also put the less emphasized subjects at greater risk of being cut completely for budgetary reasons.

2. Language instruction is a touchy issue in many countries, especially where there are long-established minority language regions. The political outcome is usually either to teach the regional language as a second language, or to teach the full curriculum in the regional language. In the US, where there are a lot of students who are recent immigrants, bilingual education in all of the home languages would be a logistical problem. The solution has been to give extra English language instruction for a couple of years, which often isn't enough for older students.

3. Specific classes aren't too important for this post, but I firmly believe that both statistics and accounting should be taught in high school, and to non-technical students they would be much more useful than advanced abstract math such as calculus. Adding statistics and accounting means every student would have at least one math classes every year until they graduate.

4. An example of a four-class day would be: 4x85 minutes of classes, plus 3x5 minutes for breaks, plus 30 minutes for lunch, plus 5 minutes for home room, for a total of 390 minutes. An example of an eight-class day would be: 8x40 minutes of classes, plus 7x5 minutes for breaks, plus 30 minutes for lunch, plus 5 minutes for home room, for a total of 390 minutes. An example of a traditional day would be: 6x50 minutes of classes, plus 5x5 minutes for breaks, plus 30 minutes for lunch, plus 5 minutes for home room, for a total of 360 minutes.

5. The percentage depends which of the two schedules is used. The 1+4 system yields 210 minutes per week per class (40+85+85), and the A/B system yields (on average) 212.5 minutes per week per class (85+85+85/2). Multiplying those counts by 40, then dividing by 9000 returns 93.3% and 94.4% of the traditional arrangement of 5 periods of 50 minutes per week per class for 36 weeks.

6. Cumulative enrollment of each annual cohort goes up over time to about 60% because some people delay attending college for various reasons, and others change their mind about attending after being in the workforce.

Friday, October 21, 2011

Long, Long Ago in a Galaxy Far, Far Away

.. a star shone. Lots of them, in fact. And somewhat more recently, some people have made it their career to look at them. That's not a bad choice, if you can hack the math. However, as science has progressed, the number of sites where cutting-edge research can be done has shrunk, especially at the optical wavelength. Because the Earth's atmosphere is opaque to much of the electromagnetic spectrum, including light to some degree, telescopes are best located at high-elevation sites. A site should also be dry, have stable air, and be upwind from large land masses so that the amount of aerosols is lower. And finally, a site should not have a lot of light pollution. Those factors limit the number of premier sites for optical astronomy to three, which are northern Chile, the island of La Palma in the Atlantic, and the islands of Hawai'i and Maui in the Pacific. Southern California would be included in that list, but the megalopolis of LOSSAN gives off too much light pollution. So the best sites in the US are farther from the coast, in Arizona and New Mexico. Western Morocco, Namibia, and Baja California are being looked at for potential locations by more observatories as other good sites fill up, but for now they remain mostly undeveloped.

All that is by of way introducing my latest maps, which are of major astronomical observatories in North America and in South America. Both maps contain all of the "research-class" telescopes that I have found on the net. Included are all optical (which includes near-UV and infrared) telescopes over 1.0m (40"), many optical telescopes down to about 0.4m depending on location, a number of project-dedicated optical telescopes, most solar telescopes, and most radio telescopes. Not included are telescopes primarily used for teaching, historic telescopes, telescopes at science museums and planetariums, telescopes used by amateurs for minor planet discovery, and indirect observing projects such as neutrino and cosmic ray observatories. There's nothing wrong with those instruments, or their purposes. But either they aren't used for research that will contribute to the body of astronomical knowledge, or they can't image distinct sources. As always, I have tried to be as thorough as possible, but there are certainly a few inaccuracies. And since I don't speak Spanish or Portuguese, the South American map is undoubtedly incomplete.

Enjoy!

All that is by of way introducing my latest maps, which are of major astronomical observatories in North America and in South America. Both maps contain all of the "research-class" telescopes that I have found on the net. Included are all optical (which includes near-UV and infrared) telescopes over 1.0m (40"), many optical telescopes down to about 0.4m depending on location, a number of project-dedicated optical telescopes, most solar telescopes, and most radio telescopes. Not included are telescopes primarily used for teaching, historic telescopes, telescopes at science museums and planetariums, telescopes used by amateurs for minor planet discovery, and indirect observing projects such as neutrino and cosmic ray observatories. There's nothing wrong with those instruments, or their purposes. But either they aren't used for research that will contribute to the body of astronomical knowledge, or they can't image distinct sources. As always, I have tried to be as thorough as possible, but there are certainly a few inaccuracies. And since I don't speak Spanish or Portuguese, the South American map is undoubtedly incomplete.

Enjoy!

Tuesday, October 18, 2011

Galaxy-class Assholes

This really takes the cake, a Nobel, several Olympic Gold medals, and as many Peabodys as O'Reilly thinks he has won:

“Who do you think pays the taxes?” said one longtime money manager. “Financial services are one of the last things we do in this country and do it well. Let’s embrace it. If you want to keep having jobs outsourced, keep attacking financial services. This is just disgruntled people."Most of us who talk about pitchforks, tumbrels, guillotines, and the like are joking. There's not going to have another French Revolution, and the people who want something like to happen that are idiots. Besides, the government has too much firepower, and employees too many people who actually get off on kicking people while they're down. But assholes like the one quoted above prove that the Occupy Wall Street protesters have valid reasons to take on banksters. Not only does he brazenly assert that American legislators should respond to campaign donations, not the voters, which should be enough to get everyone out on the street by itself. But he also shows that Wall Street doesn't understand the American economy or the role of finance in it, and needs to be beaten down for that reason, too. A large, continent-spanning country of 310 million people can't survive on a financial sector concentrated in one city. Only very small countries (less than 1 million people) can. Even Switzerland, which is basically synonymous with banking secrecy and profiting from illicit wealth, has a large and healthy manufacturing sector (albeit with a higher portion of luxury goods makers than most). A big country like the United States has to be good at making stuff. And it is, in some sectors - airplanes and software most notably. The role of a financial sector in such a country should be to facilitate the rest of the economy. Instead, Wall Street has taken to profiting from the decline of other manufacturing sectors, and from increasing inequality. It has both fed and gotten wildly rich from the increasing amount of debt Americans have accumulated in order to maintain their way of life as their incomes have been squeezed. OWS is an entirely legitimate response to the problem the US financial system poses for the vast majority of the citizens of the US.

He added that he was disappointed that members of Congress from New York, especially Senator Charles E. Schumer and Senator Kirsten Gillibrand, had not come out swinging for an industry that donates heavily to their campaigns. “They need to understand who their constituency is,” he said.

Saturday, October 15, 2011

Picture This and That: Look at Dat Glass Edition

Photographic lenses, or "glass" in photographer slang, are something a lot of first-time interchangeable lens camera buyers don't really think about when they make their purchase. But they should. In a previous post I said, "there is no point in buying a $1000 receiver and $400 pair of speakers" because bad speakers will degrade source material no matter how good the receiver is. A better analogy would have been, "there is no point in buying a $2000 mixing board and plugging in $15 microphones" because cameras and lenses are visual recording instruments. There may be times when a person would want to use a low-fidelity input device such as a cheap microphone or a plastic camera lens because of the effect it gives. But the same effect can usually be done in processing (mixing or editing), whereas upgrading to a clean picture or recording is difficult or impossible. Photographers usually aim to get the clearest image possible for that reason.

Below are my notes about lenses.

Basic terminology - these are some frequently used terms.

Below are my notes about lenses.

Basic terminology - these are some frequently used terms.

- Extension tube - mounts between a body and lens to decrease the focal length

- Fast - a lens with a large maximum aperture, generally considered to be f/1.4 to f/2.8 depending on the type of lens, but exotic (read: expensive) lenses can be faster

- Filter - blocks a certain portion of incoming light from passing through it; generally screws onto the end of the lens, but some lenses have a filter tray near the middle of the lens barrel

- Fisheye - a lens with a very wide field of view and exaggerated distortion

- Fixed-focus - typically used only on very low-end cameras

- Kit - a lens that comes with the camera, often a 28-85mm zoom

- Macro - a lens that allows for close-up work, with minimal magnification

- Macro filter - not a filter; mounts on the end of lens to allow close-up work

- Portrait - a slightly long-focus lens, with a focal length of 85mm to 105mm

- Prime - fixed focal-length lens

- Standard or normal - a lens that gives a field of view similar to the human eye, typically 50mm for 35mm cameras, with a range from 40mm to 55mm

- Teleconverter - mounts between a body and lens to increase the focal length

- Telephoto - a long-focus lens that enlarges distant subjects, with a focal length of 105mm or greater

- Teleside converter - mounts on the front of a lens to increase the focal length

- Tilt-shift or perspective control - specialty lens used by professionals

- Wide-angle - a lens that allows for a greater field of view, with a focal length of 35mm or less

- Zoom - a variable focal length lens

- Nikon - F mount lenses

- Canon - EF mount and EF-S mount lenses

- Sony - Alpha mount (formerly Minolta AF mount) and E mount lenses

- Pentax - K mount and Q mount lenses

- Olympus - FT mount and mFT mount lenses

- Panasonic - FT mount and mFT mount lenses

- Samsung - NX mount lenses

- Ricoh - GXR integrated sensor/lens units

- Pentax, Hasselblad, and Mamiya/Leaf/Phase One make medium format lenses for their own cameras

- Leica - S mount and M mount lenses

- Sigma - SA mount lenses, plus it is one of the "big three" third-party makers

- Tokina - one of the "big three" third-party makers

- Tamron - one of the "big three" third-party makers

- Samyang - Korean manufacturer that makes lenses for a lot of rebranders

- Zeiss - high-end lenses

- Schneider - tilt-shift lenses

- Hartblei - tilt-shift lenses

- Arax - tilt-shift and fisheye lenses

- Voigtländer - Cosina makes lenses under this name

- LZOS - Russia company selling two fisheyes

- KMZ - Russia company with several lenses, usually branded Zenitar

- Belomo - Belorussian company with several lenses

- Kowa - makes only one telephoto lens that can also be used as a sighting scope

- Noktor - fast (large aperture) lens made for SLR Magic

- Rodenstock, Schneider, Fujinon, and Nikon are the main large-format lens manufacturers

- Congo, Osaka, Cooke Optics, and perhaps other very low volume manufacturers also make large format lenses

- Vivitar - for a long time this was the largest rebrander in the US. It sometimes even had its own lens designs made by others. It seems to have stopped making lenses, though they are still available from some retailer

- Rokinon - lenses mostly seem to be Samyang

- Promaster - Wolf Camera "house" brand

- Pro Optic - may be Adorama "house" brand; lenses mostly seem to be Samyang

- Bower - may be B&H "house" brand; lenses mostly seem to be Samyang

- Quantary - Ritz Camera "house" brand

- Phoenix - Samyang captive brand

- Opteka - may be 47th Street Photo "house" brand; lenses mostly seem to be Samyang

- Kenko - Tokina lenses are sometimes sold under this captive brand

- and probably others around the world; historically there have been hundreds of such brands

- Sinar, Linhof, and Caltar apparently rebrand large-format lenses

- Lensbaby - low-fi tilt-shift and fisheye lenses

- Holga - low-fi lenses

- Sunex - super fisheye lens

- Wanderlust - pinhole lens

- SLR Magic - low-fi lenses available on e-Bay

- Subjektiv - 4-in-1 low-fi lens

- Loreo - body cap lenses

- Jenoptik - UV & IR lenses

| Mount | Brand | Name | Type | AF | FD Min | FD Max | Eq. Min | Eq. Max |

|---|---|---|---|---|---|---|---|---|

| CX | Nikon | Nikkor 10mm f/2.8 | Wide prime | Yes | 10 | 10 | 27 | 27 |

| CX | Nikon | Nikkor VR 10-30mm f/3.5-5.6 | Standard zoom | Yes | 10 | 30 | 27 | 81 |

| CX | Nikon | Nikkor VR 10-100mm f/4.5-5.6 PD-zoom | Super zoom | Yes | 10 | 100 | 27 | 270 |

| CX | Nikon | Nikkor VR 30-110mm f/3.8-5.6 | Telephoto zoom | Yes | 30 | 110 | 81 | 297 |

| E | Rokinon | 8mm Ultra wide Angle f/3.5 Fisheye Lens | Fisheye prime | No | 8 | 8 | 12 | 12 |

| E | Sony | 16mm f/2.8 wide-Angle Lens | Wide prime | Yes | 16 | 16 | 24 | 24 |

| E | Sony | 18-55mm f/3.5-5.6 Zoom Lens | Standard zoom | Yes | 18 | 55 | 27 | 83 |

| E | Sony | 18-200mm f/3.5-6.3 Zoom Lens | Super zoom | Yes | 18 | 200 | 27 | 300 |

| E | Sony | Carl Zeiss 24mm f/1.8 Lens | Wide prime | Yes | 24 | 24 | 36 | 36 |

| E | Sony | 30mm f/3.5 Macro Lens | Normal prime | Yes | 30 | 30 | 45 | 45 |

| E | Sony | 50mm f/1.8 Telephoto Lens | Telephoto prime | Yes | 50 | 50 | 75 | 75 |

| E | Sony | 55-210mm Zoom Lens | Telephoto zoom | Yes | 55 | 210 | 83 | 315 |

| E | Noktor | HyperPrime 50mm f/0.95 | Telephoto prime | No | 50 | 50 | 75 | 75 |

| mFT | Panasonic | Lumix G Vario 7-14mm F4.0 Asph. | Wide zoom | Yes | 7 | 14 | 14 | 28 |

| mFT | Samyang | 7.5mm 1:3.5 UMC Fisheye MFT | Fisheye prime | No | 8 | 8 | 15 | 15 |

| mFT | Panasonic | Lumix G Fisheye 8mm F3.5 | Fisheye prime | Yes | 8 | 8 | 16 | 16 |

| mFT | Olympus | M.Zuiko Digital ED 9-18mm F4.0-5.6 | Wide zoom | Yes | 9 | 18 | 18 | 36 |

| mFT | Wanderlust | Pinwide | Specialty lens | No | 11 | 11 | 22 | 22 |

| mFT | Olympus | M.Zuiko Digital ED 12mm F2.0 | Wide prime | Yes | 12 | 12 | 24 | 24 |

| mFT | Panasonic | Lumix G 14mm F2.5 Asph. | Wide prime | Yes | 14 | 14 | 28 | 28 |

| mFT | Olympus | M.Zuiko Digital ED 14-42mm F3.5-5.6 | Standard zoom | Yes | 14 | 42 | 28 | 84 |

| mFT | Olympus | M.Zuiko Digital 14-42mm F3.5-5.6 II | Standard zoom | Yes | 14 | 42 | 28 | 84 |

| mFT | Olympus | M.Zuiko Digital 14-42mm F3.5-5.6 II R | Standard zoom | Yes | 14 | 42 | 28 | 84 |

| mFT | Panasonic | Lumix G Vario 14-42mm F3.5-5.6 Asph. Mega O.I.S. | Standard zoom | Yes | 14 | 42 | 28 | 84 |

| mFT | Panasonic | Lumix G X Vario PZ 14-42mm F3.5-5.6 Asph. Power O.I.S. | Standard zoom | Yes | 14 | 42 | 28 | 84 |

| mFT | Panasonic | Lumix G Vario 14-45mm F3.5-5.6 Asph. Mega O.I.S. | Standard zoom | Yes | 14 | 45 | 28 | 90 |

| mFT | Panasonic | Lumix G Vario HD 14-140mm F4.0-5.8 Asph. Mega O.I.S | Super zoom | Yes | 14 | 140 | 28 | 280 |

| mFT | Olympus | M.Zuiko Digital ED 14-150mm F4.0-5.6 | Super zoom | Yes | 14 | 150 | 28 | 300 |

| mFT | Olympus | M.Zuiko Digital 17mm F2.8 | Wide prime | Yes | 17 | 17 | 34 | 34 |

| mFT | Panasonic | Lumix G 20mm F1.7 Asph. | Wide prime | Yes | 20 | 20 | 40 | 40 |

| mFT | Panasonic | Leica DG Summilux 25mm F1.4 Asph. | Normal prime | Yes | 25 | 25 | 50 | 50 |

| mFT | Voigtlander | Nokton 25mm F0.95 | Normal prime | No | 25 | 25 | 50 | 50 |

| mFT | Olympus | M.Zuiko Digital ED 40-150mm F4.0-5.6 | Telephoto zoom | Yes | 40 | 150 | 80 | 300 |

| mFT | Olympus | M.Zuiko Digital ED 40-150mm F4.0-5.6 R | Telephoto zoom | Yes | 40 | 150 | 80 | 300 |

| mFT | Olympus | M.Zuiko Digital 45mm F1.8 | Telephoto prime | Yes | 45 | 45 | 90 | 90 |

| mFT | Panasonic | Leica DG Macro-Elmarit 45mm F2.8 Asph. Mega O.I.S. | Telephoto prime | Yes | 45 | 45 | 90 | 90 |

| mFT | Panasonic | Lumix G X Vario PZ 45-175mm F4.0-5.6 Asph. Power O.I.S. | Telephoto zoom | Yes | 45 | 175 | 90 | 350 |

| mFT | Panasonic | Lumix G Vario 45-200mm F4.0-5.6 Mega O.I.S | Telephoto zoom | Yes | 45 | 200 | 90 | 400 |

| mFT | Noktor | HyperPrime 50mm f/0.95 | Telephoto prime | No | 50 | 50 | 100 | 100 |

| mFT | Olympus | M.Zuiko Digital ED 75-300mm F4.8-6.7 | Telephoto zoom | Yes | 75 | 300 | 150 | 600 |

| mFT | Panasonic | Lumix G Vario 100-300mm F4.0-5.6 Mega O.I.S | Telephoto zoom | Yes | 100 | 300 | 200 | 600 |

| NX | Samyang | 8mm F3.5 Fisheye | Fisheye prime | No | 8 | 8 | 12 | 12 |

| NX | Samyang | 14mm F2.8 IF ED MC Aspherical | Wide prime | No | 14 | 14 | 21 | 21 |

| NX | Samsung | 16mm F2.4 Pancake | Wide prime | Yes | 16 | 16 | 24 | 24 |

| NX | Samsung | 16-80mm F3.5-4.5 OIS | Standard zoom | Yes | 16 | 80 | 24 | 120 |

| NX | Samsung | 18-55mm Portrait Lens | Standard zoom | Yes | 18 | 55 | 27 | 83 |

| NX | Samsung | Compact 18-55mm Zoom Lens | Standard zoom | Yes | 18 | 55 | 27 | 83 |

| NX | Samsung | 18-200mm Multi-Purpose Lens | Super zoom | Yes | 18 | 200 | 27 | 300 |

| NX | Samsung | 20mm NX Pancake Lens | Wide prime | Yes | 20 | 20 | 30 | 30 |

| NX | Samsung | Ultra Compact 20-50mm Zoom Lens | Standard zoom | Yes | 20 | 50 | 30 | 75 |

| NX | Samyang | 24mm f/1.4 ED AS UMC | Wide prime | No | 24 | 24 | 36 | 36 |

| NX | Samsung | 30mm NX Pancake Lens | Normal prime | Yes | 30 | 30 | 45 | 45 |

| NX | Samyang | 35mm F1.4 AS UMC | Normal prime | No | 35 | 35 | 53 | 53 |

| NX | Samsung | 50-200mm Telephoto Zoom Lens | Telephoto zoom | Yes | 50 | 200 | 75 | 300 |

| NX | Samsung | 50-200mm NX Telephoto OIS Lens | Telephoto zoom | Yes | 50 | 200 | 75 | 300 |

| NX | Samsung | 60mm F2.8 Macro ED OIS SSA | Telephoto prime | Yes | 60 | 60 | 90 | 90 |

| NX | Samsung | 85mm F1.4 ED SSA | Telephoto prime | Yes | 85 | 85 | 128 | 128 |

| NX | Samyang | 85mm F1.4 Aspherical IF | Telephoto prime | No | 85 | 85 | 128 | 128 |

| Q | Pentax | Fish-Eye 3.2mm f/5.6 | Fisheye prime | No | 3 | 3 | 18 | 18 |

| Q | Pentax | Standard zoom 5-15mm f/2.8-4.5 | Standard zoom | Yes | 5 | 15 | 28 | 84 |

| Q | Pentax | Toy Lens wide 6.3mm f/7.1 | Specialty lens | No | 6 | 6 | 35 | 35 |

| Q | Pentax | Standard Prime 8.5mm f/1.9 AL [IF] | Normal prime | Yes | 9 | 9 | 48 | 48 |

| Q | Pentax | Toy Lens Telephoto 18mm f/8 | Specialty lens | No | 18 | 18 | 101 | 101 |

Finally-ish

Praise FSM and pass the stuffing. Okay, there may be as many as 150 directly-employed US troops left, along with 5,000 or more indirectly employed troops and 11,000 other people at the US "embassy" in Baghdad, but the US will officially stop occupying at least one country this year.

After over eight years and nine months, George Bush's entirely unnecessary war will finally end.

After over eight years and nine months, George Bush's entirely unnecessary war will finally end.

Friday, September 30, 2011

Picture This and That: October 2011 Comparison Chart

There have been several new interchangeable lens digital cameras announced recently, so here's a chart of what's available today. The newcomers are the Nikon J1 and V1 mirrorless system cameras, the Sony A65 and A77 single lens translucent cameras, the Sony NEX-5N and NEX-7 MSCs, and the Samsung NX200 MSC. Sony, Olympus, and Pentax each put two DSLR models to bed. Sony still has two consumer DSLRs on the market, but I didn't show them because the SLT technology is clearly the future for Sony. There are no links this time; if you want more details you can click away in the previous post.

Update 2011/10/03: All Sony DSLRs have been discontinued in Japan, and the same should happen in the US sometime soon.

| Big 2 | Upstart | Little 4 | ||||||

|---|---|---|---|---|---|---|---|---|

| Camera category | Brand (2010 ILC market share) | Canon (45%) | Nikon (30%) | Sony (12%) | Pentax (?) | Olympus (5%) | Panasonic (?) | Samsung (?) |

| RF-style MSC price w/ zoom | Low-end | - | - | NEX-C3 16.2MP $550 | - | E-PM1 12.3MP $500 | - | NX100 14.6MP $425 |

| Mid-Range | - | J1 10.1MP $650 | NEX-5n 16.1M $700 | - | E-PL3 12.3MP $650 | DMC-GF3 12.1MP $675 | - | |

| High-end | - | V1 10.1MP $900 | NEX-7 24.1MP $1350 | Q 12.4MP $900 | E-P3 12.3MP $900 | - | NX200 20.3MP $900 | |

| Consumer DSLR / SLT / MSC price w/ zoom | Beginner | 1100D/T3 12.2MP $550 | D3100 14.2MP $600 | SLT-A35 16.2MP $600 | K-r 12.4MP $600 | E-620 12.2MP $600 | - | NX11 14.6MP $550 |

| Mid-Range | 600D/T3i 18.0MP $850 | D5100 16.2MP $800 | SLT-A55 16.2MP $800 | - | - | DMC-G3 15.8MP $700 | - | |

| Enthusiast | 60D 18.0MP $1200 | D7000 16.2MP $1450 | SLT-A65 24.3MP $1000 | K-5 16.3MP $1350 | - | DMC-GH2 16.1MP $1000 | - | |

| Professional DSLR / SLT price body only | Mid-size | 7D 18.0MP $1600 | D300s 12.3MP $1600 | SLT-A77 24.3MP $1400 | - | E-5 12.3MP $1500 | - | - |

| Mid-size full frame | 5D Mk.II 21.0MP $2400 | D700 12.1MP $2700 | DSLR-A900 24.3MP $2700 | - | - | - | - | |

| Flagship action | 1D Mk.IV 16.1MP $5000 | D3s 12.1MP $5200 | - | - | - | - | - | |

| Flagship studio | 1Ds Mk.III 21.1MP $7000 | D3x 24.5MP $8000 | - | - | - | - | - | |

Update 2011/10/03: All Sony DSLRs have been discontinued in Japan, and the same should happen in the US sometime soon.

Monday, September 26, 2011

Another Dismal (Social) Scientist

Via Atrios comes this short column in the Guardian by Stergios Skaperdas that goes into a bit more detail about the mechanics of a Greek default and exit from the Eurozone. The shorter on the column is: default is better than massive deflation, and default will bankrupt Greek banks, and to recapitalize them Greece will need its own currency, and it will have to institute tight currency and capital controls for a while, and all of that requires planning, which hasn't been started as far as anyone knows. So, either the Greek government is executing masterfully, as evidenced by there being no indication whatsoever that it is about to default, or it is failing the Greek people. I'm going to say it's the latter, as governments are failing their citizens all over the place these days.

The Dismal (Social) Scientist

I think Krugman is getting a bit frustrated. Well, more frustrated. So frustrated, in fact, he Godwined-in-all-but-name his own column. Today he also comes about as close to calling the Eurozone elites idiots as is possible within the NYT's civility rules. He's done so more-or-less explicitly on his blog, but that probably has a readership that is smaller by a factor of 10 or 20. Maybe a more prominently-place tongue-lashing will have an effect, though I wouldn't count on it.

One reason for Krugman to lash out is that The Big, Fat Greek Depression continues. The NYT has a good color article today on what the austerity is doing to the typical Greek family. Real household income for the Firigou family has fallen about 40% between pension cuts, salary cuts, and increased taxes. But at least they still have income. Lots of families are undoubtedly doing much worse.

I still haven't found a good explanation for why the Greek government, which is currently controlled by the nominally left-wing Panhellenic Socialist Movement, refuses to default. Is it national pride, or are they genuinely worried about private external debt problems? Those would remain, and get much worse, if Greece defaulted and switched to a new currency. I suspect most wealthy Greeks have transferred most of their liquid wealth to some other location, so that reason should not be holding the politicians up. It's a puzzle I can't crack from afar.

ETA: Some schnitzel from Germany expects Greece to suffer for a whole decade? That will certainly happen if it doesn't default. On the up side, the Italian Economy Minister Giulio Tremonti is pushing back on Germany's approach pretty hard, at least in that article.

One reason for Krugman to lash out is that The Big, Fat Greek Depression continues. The NYT has a good color article today on what the austerity is doing to the typical Greek family. Real household income for the Firigou family has fallen about 40% between pension cuts, salary cuts, and increased taxes. But at least they still have income. Lots of families are undoubtedly doing much worse.

I still haven't found a good explanation for why the Greek government, which is currently controlled by the nominally left-wing Panhellenic Socialist Movement, refuses to default. Is it national pride, or are they genuinely worried about private external debt problems? Those would remain, and get much worse, if Greece defaulted and switched to a new currency. I suspect most wealthy Greeks have transferred most of their liquid wealth to some other location, so that reason should not be holding the politicians up. It's a puzzle I can't crack from afar.

ETA: Some schnitzel from Germany expects Greece to suffer for a whole decade? That will certainly happen if it doesn't default. On the up side, the Italian Economy Minister Giulio Tremonti is pushing back on Germany's approach pretty hard, at least in that article.

Friday, September 23, 2011

Mini to the Max

I just finished upgrading my iPod Mini Gen. 2, and it was a fairly straightforward procedure. I mangled the aluminum case slightly getting the top and bottom plates off. But I'm hardly a fashionista, and it never leaves the house, so I don't care. (I use it with various sub/sat systems positioned around the house.) I do care that even with the old 6GB microdrive still installed, the new battery boosted play time from 2-3 hours to at least 15. I haven't tested the play time with the flash card, but it should be even greater. You don't need a super-fast flash card when upgrading, as the specs on the microdrive weren't all that great. The battery and the flash card cost about $37 including shipping. There are instructions on how to do this all over the intertubes.

Thursday, September 22, 2011

Default Already, Dammit

This is fucking nuts. The Eurozone is experiencing a self-inflicted disaster, but the perpetrators won't be made to pay.

Update 2011/09/23: Krugman lists some of the perpetrators, and then wonders about the social dynamics inside those organizations. It's a good question. It seems to me that in the West, the financial industry has triumphed in several countries, most notably the US and the UK. And there have been conservative governments in many countries which have appointed conservative-leaning people to those institutions. Those countries include the US (2001-2009), Canada (2006-present), Germany (2005-present), France (1995-present), Australia (1996-2007), and Italy (2001-2005 and 2008-present). The UK also had a nominally left-wing but very finance-friendly government from 1997 to 2010, when the Conservatives took over. Ditto for the US from 1993 to 2001. The policies and opinions of the international financial institutions (BIS, IMF, ECB, and WB, plus the OECD which is a data and analysis operation) reflect those factors. The low-inflation, low-regulation leanings of the leaders have filtered down from the top, as well as in from the side, though lower-level channels, from the finance industry, which those organizations deal with on a regular basis.

Update 2011/09/23: Krugman lists some of the perpetrators, and then wonders about the social dynamics inside those organizations. It's a good question. It seems to me that in the West, the financial industry has triumphed in several countries, most notably the US and the UK. And there have been conservative governments in many countries which have appointed conservative-leaning people to those institutions. Those countries include the US (2001-2009), Canada (2006-present), Germany (2005-present), France (1995-present), Australia (1996-2007), and Italy (2001-2005 and 2008-present). The UK also had a nominally left-wing but very finance-friendly government from 1997 to 2010, when the Conservatives took over. Ditto for the US from 1993 to 2001. The policies and opinions of the international financial institutions (BIS, IMF, ECB, and WB, plus the OECD which is a data and analysis operation) reflect those factors. The low-inflation, low-regulation leanings of the leaders have filtered down from the top, as well as in from the side, though lower-level channels, from the finance industry, which those organizations deal with on a regular basis.

Wednesday, September 14, 2011

Our Skies Are Bigger Than Our Wallet

Today, NASA announced its plan to develop a heavy lift vehicle (aka rocket) called - rather uncreatively - the Space Launch System (SLS). It would use many parts and technologies from the Space Shuttle program in an effort to save money. But despite that, the cost is huge: $3 billion annually through the first test flight in 2017, for a total of $18B. That's too much, as far as I am concerned, especially in light of the fact there is no defined need for it. There's plenty of hoped-for missions amongst human spaceflight supporters, such as to the Moon and to Mars, but those are entirely unfunded at this point. If the cost was lower, then I would support the program despite its speculative nature. But at $3B per year, the funding will definitely eat into other programs. I have no idea if the $18B price tag is justified in terms of the manpower and materials needed to accomplish the task, or if that number is bloated due to too much contracting and sub-contracting. I do know that making the SLS man-rated will add to the cost, and as I explained before, there's no reason to do so given the parallel development of commercial capsules and the availability of the Russian Soyuz vehicle (though the Soyuz launch system had a small problem last month).

At this point the best option for a heavy lift vehicle is the Falcon Heavy, which has a test launch scheduled in early 2013. It will only have a maximum capacity of 50,000 kg to low-earth orbit, as compared to 70,000 kg for the first launch of the SLS, which is intended to have a maximum capacity of 130,000 kg. But the Falcon Heavy will be available much sooner, at a much lower cost, and, again, as of now there is no defined need to lob something that heavy into orbit. If for some reason a larger spacecraft is needed, it can be assembled in orbit, just like the Space Station has been. That would add costs to a mission, but probably not so much that the $18B SLS program would become justified.

At this point the best option for a heavy lift vehicle is the Falcon Heavy, which has a test launch scheduled in early 2013. It will only have a maximum capacity of 50,000 kg to low-earth orbit, as compared to 70,000 kg for the first launch of the SLS, which is intended to have a maximum capacity of 130,000 kg. But the Falcon Heavy will be available much sooner, at a much lower cost, and, again, as of now there is no defined need to lob something that heavy into orbit. If for some reason a larger spacecraft is needed, it can be assembled in orbit, just like the Space Station has been. That would add costs to a mission, but probably not so much that the $18B SLS program would become justified.

Sunday, September 11, 2011

Tenth Aniversary Pre-buttal

I'm tuning out for the next 24+ hours, because it's been a shitty decade, and all the talk about service and sacrifice and heroism and hope and whatever can't erase the fact that it's been a shitty decade.

Thanks, PresidentBush Cheney.

Thanks, President

Friday, September 9, 2011

Bestest Grafick Evah

From this Robert Reich op-ed, which is good, comes the graphic below, which is great.

This is the best summary of the negative trends that have pinched the middle class over the last 35 years. The point about women working comes across as slightly sexist, but I don't think the equivalent data for both sexes (dads can stay at home, too) exists, at least for the time period involved. So the excellent NYT graphics department used the best available series.

We've been running the Republican experiment since the 1980s - cut taxes, cut social spending, cut public investment, increase war and security spending, and outsource much of the latter - and it hasn't produced good results for the majority of Americans. The underlying trends - globalization, computerization - would still exist if we had stuck with Democratic policies, but overlaying Republican policies on those trends has amplified them. Capital moves quicker and farther than labor, and giving more capital to the rich has only allowed them to shuffle it around with greater ease, dragging jobs with it.

This is the best summary of the negative trends that have pinched the middle class over the last 35 years. The point about women working comes across as slightly sexist, but I don't think the equivalent data for both sexes (dads can stay at home, too) exists, at least for the time period involved. So the excellent NYT graphics department used the best available series.

We've been running the Republican experiment since the 1980s - cut taxes, cut social spending, cut public investment, increase war and security spending, and outsource much of the latter - and it hasn't produced good results for the majority of Americans. The underlying trends - globalization, computerization - would still exist if we had stuck with Democratic policies, but overlaying Republican policies on those trends has amplified them. Capital moves quicker and farther than labor, and giving more capital to the rich has only allowed them to shuffle it around with greater ease, dragging jobs with it.

Monday, September 5, 2011

Monday, August 22, 2011

From the Annals of the Entirely Unsurprising

The NY Times reports today that the Japanese government is about to declare a significant area around the Fukushima Dai-ichi Nuclear Power Plant as uninhabitable for the foreseeable future. It's not going to buy the properties in the no-go zone, however. The Japanese government will rent them instead. That's a good way of putting off the day of reckoning, which would cost a pretty penny. (I'm likely off with all of these numbers but the scale is what is important here.) If we use a price of $200,000 per home, every 5,000 homes condemned would cost about $1 billion to buy. That's not much compared to Japan's GDP, but renting would only cost about $90 million per year if the monthly rent is $1500. That adds up quickly, of course, but in 11 or 13 years, when the rental costs surpass the cost of outright purchase plus interest, none of the politicians in charge will be around.

I think what is likely to happen in somewhat cramped Japan is that the worst affected areas will be bought in 5 or 10 years, partially cleaned, and then converted into large industrial districts. The population of Japan is already declining, so the housing units won't be missed that much (from an economic perspective). In the meantime, tens of thousands of people will be left in limbo, not able to sell and move on, or go home. And so the crisis will continue for years, even after the reactors are brought under control.

I think what is likely to happen in somewhat cramped Japan is that the worst affected areas will be bought in 5 or 10 years, partially cleaned, and then converted into large industrial districts. The population of Japan is already declining, so the housing units won't be missed that much (from an economic perspective). In the meantime, tens of thousands of people will be left in limbo, not able to sell and move on, or go home. And so the crisis will continue for years, even after the reactors are brought under control.

Wednesday, August 17, 2011

Smoke Two Joints

phhhhhhhhhhHHHHHHtt.... wah? O hai.

Actually, I don't smoke anything, or even drink these days. But this writeup at Wired of some fascinating research makes me think I should start ... if it were legal. It turns out not only does using pot not make you permanently stupid, it actually makes you smarter in one particular way when you're high - word association. It's a little more complicated than that, of course. And there is some reduction in short-term verbal memory among current heavy users. But overall, this is another piece of evidence that supports the decriminalization of marijuana. The harm caused by criminalization continues to far outweigh the harm caused by the drug itself.

On a strictly anecdotal basis, I've always thought the dumb stoner/hippy affect was a sub-cultural artifact. The whole "oh, wow, man" attitude may be induced by getting high, but its carryover to the rest of people's waking lives was a learned trait. Fortunately the sub-culture has mostly gone away, especially now that The Dead are dead.

Actually, I don't smoke anything, or even drink these days. But this writeup at Wired of some fascinating research makes me think I should start ... if it were legal. It turns out not only does using pot not make you permanently stupid, it actually makes you smarter in one particular way when you're high - word association. It's a little more complicated than that, of course. And there is some reduction in short-term verbal memory among current heavy users. But overall, this is another piece of evidence that supports the decriminalization of marijuana. The harm caused by criminalization continues to far outweigh the harm caused by the drug itself.

On a strictly anecdotal basis, I've always thought the dumb stoner/hippy affect was a sub-cultural artifact. The whole "oh, wow, man" attitude may be induced by getting high, but its carryover to the rest of people's waking lives was a learned trait. Fortunately the sub-culture has mostly gone away, especially now that The Dead are dead.

Wednesday, August 10, 2011

Is Our Central Bankers Learning?

Twice in the past three days, important central banks have actually done something slightly positive. Sunday night it was the European Central Bank deciding to intervene in the Italian and Spanish sub-sovereign bond markets. Yesterday it was the Federal Reserve setting expectations on how long it plans to keep its current low-interest rate policy. The ECB's intervention has worked, at least temporarily, as the interest rate premiums for both countries vs. Germany have dropped sharply (divide the numbers by 100 to get real world units). The Fed's statement was aimed at general sentiment, not any specific index, so it's a little early to say if it worked.

In both cases, however, the gap between what is being done and what should be done is still far too wide. Hopefully, these two actions were just first steps towards more sensible policies.

Update: 2011.08.11: Yves Smith talks about the central bank actions.

In both cases, however, the gap between what is being done and what should be done is still far too wide. Hopefully, these two actions were just first steps towards more sensible policies.

Update: 2011.08.11: Yves Smith talks about the central bank actions.

Tuesday, August 9, 2011

What Goes Down Must Come Up?

Thank goodness our markets are so eminently rational.

Here's an annotated chart of today's market movements. In 30 minutes, starting at 2:15 when the Federal Reserve Open Market Committee released its latest meeting statement, the DJI went up by 77 points, then down 227 points, then up 146 points, and finally down 285 points. In the 75 minutes from 2:45 to the close (the computers took about 7 minutes to spit out the final number) the DJI increased 624 points, or about 5.8% from the intra-day low.

Is there any possible justification for this kind of herd behavior?

Here's an annotated chart of today's market movements. In 30 minutes, starting at 2:15 when the Federal Reserve Open Market Committee released its latest meeting statement, the DJI went up by 77 points, then down 227 points, then up 146 points, and finally down 285 points. In the 75 minutes from 2:45 to the close (the computers took about 7 minutes to spit out the final number) the DJI increased 624 points, or about 5.8% from the intra-day low.

Monday, August 8, 2011

Friday, August 5, 2011

Up, Down, Turn Around

I want to thank S&P for providing me with this evening's quota of humor. If you're going to do something as momentous as downgrading the U.S. Government's credit rating, at least get the numbers right first. And after embarrassing itself so thoroughly, I suspect S&P went through with the change mostly so it could distract everybody from its foolishness.

On the sober, serious side, Salmon has some good comments on the situation. The US remains the richest country in the world, with very low tax rates compared with other industrialized countries. But the political risk of default isvery, very real. Heck, if "the deal" had been bad enough, I would have been willing to bring on the default. As it turned out, the deal is merely mildly counterproductive - at least until the new and improved Catfood Commission II reports in. But the entire crisis was purposely contrived to extract spending cuts that the Teahadists wouldn't have been able to negotiate with the Senate and White House. The best analogy I can come up with is a doctor holding a pneumonia patient hostage by threatening to shoot the patient unless the doctor is allowed to amputate a leg. The US is suffering through a huge jobs crisis, but the Teahadists want to cut government spending, and they were willing shut the US government down and ruin its credit rating in order to get what they wanted. Fortunately (or not), all they got was a promise to consider amputation in a few months.

BREAKING! MUST CREDIT... just about everyone. Okay, here's some text from S&P's release:

Added: Krugman weighs in with a somewhat harsher view of S&P than Salmon.

Added: Drum thinks the risk of actual default was and is remote. I used to think that, but I no longer believe that the Teahadists are under anybody's control.

Added: Here's a good post on why the practical effects of a downgrade - even by all three agencies - are likely to be minimal. I largely agree, though I would qualify it with "in the short term" more explicitly. Another qualifier that I would add is "provided nothing bad happens elsewhere." A breakup of the Euro would send investors piling into any US asset, especially Treasuries, driving down yields sharply.

On the sober, serious side, Salmon has some good comments on the situation. The US remains the richest country in the world, with very low tax rates compared with other industrialized countries. But the political risk of default is

BREAKING! MUST CREDIT... just about everyone. Okay, here's some text from S&P's release:

We lowered our long-term rating on the U.S. because we believe that the prolonged controversy over raising the statutory debt ceiling and the related fiscal policy debate indicate that further near-term progress containing the growth in public spending, especially on entitlements, or on reaching an agreement on raising revenues is less likely than we previously assumed and will remain a contentious and fitful process.Heh-indeedy. Unfortunately, the rest is worse. But that's not surprising, as the way S&P inserted itself in the debate to begin with showed that it was clearly on one side. The release as whole is basically a continuation of their pressure to act in a certain way.

Added: Krugman weighs in with a somewhat harsher view of S&P than Salmon.

Added: Drum thinks the risk of actual default was and is remote. I used to think that, but I no longer believe that the Teahadists are under anybody's control.

Added: Here's a good post on why the practical effects of a downgrade - even by all three agencies - are likely to be minimal. I largely agree, though I would qualify it with "in the short term" more explicitly. Another qualifier that I would add is "provided nothing bad happens elsewhere." A breakup of the Euro would send investors piling into any US asset, especially Treasuries, driving down yields sharply.

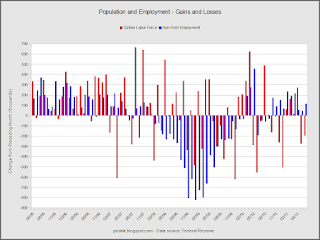

How's That Working For You: July 2011 Edition

Here's the latest in another chart series that I abandoned for a while.

The recession is pretty obvious here.

I think the data speaks for itself.

And here.

The unemployment rate is staying high instead of declining from a peak as it did in 1981.

Next are zoomed versions of the previous two graphs

Population growth has slipped below 1%.

The labor force data has become very noisy since the beginning of the pre-recession in early 2007. That's when people started experiencing that Wile E. Coyote moment and growth slowed.

Thursday, August 4, 2011

She's Got a Trichet to Ride

Megadiving in the markets today. Nobody knows for sure what fears live in the hearts of market makers, but today it seems to be goings-on in Yurp, where the German-Italian bond spread continues to balloon. The ECB's policies have been disastrous, predictably.

The most interesting proposal to resolve the crisis is this one from Ambrose Evans-Pritchard. Generally I find AE-P to be a bit of a breathless blowhard, but at first glance the idea that Germany should withdraw from the Euro is quite intriguing. Germany, along with a few others in concert, are more likely to be able to pull off a orderly withdrawal because they are more likely to be able to keep the whole thing secret. Discretion during any unplanned currency switchover is very important, because public knowledge is likely to trigger a bank run. (The situation is different if the changeover is announced years in advance, as happened with the formation of the Euro.) The new currency - lets call it the nordmark - would appreciate against the rump Euro, allowing the South European countries to regain competitiveness and grown their economies without suffering through years of deflation first..