To follow up on the previous post, here are some graphs on details of the economy.

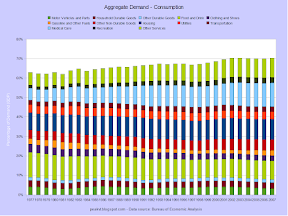

In the previous post I showed that America would have to lower its consumption by about 6pp in the near-term (1-5 years) and by over 12pp in the medium-term (10-20 years). A look at the finer details of goods and services doesn't reveal any categories where consumers can cut back by large amounts quickly, except perhaps financial services (those certainly haven't been helping anyone lately). On the other hand, where it comes from isn't so important. As long as consumers cut back somewhere, they should be free to decide exactly where.

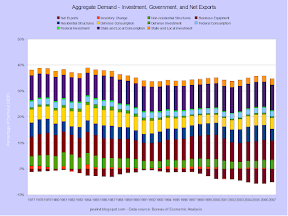

The question then becomes one of how to make consumers cut back. The inevitable fall of the dollar against other currencies will cause part of the adjustment - provided the rest of the world doesn't engage in competitive devaluation. More expensive imports means less imports, and American-made goods will be more competitive overseas. Another part will come from necessity. Now that the twin bubbles have decimated both private-sector retirement plans and housing values in large sections of the country, many people may (will) decide to live within their means for a few years. A subset of those people will be saving desperately as retirement looms and assets are found to be much less than expected. And, finally, some of the adjustment will be due to increased taxation, first to bring the budget back into balance, and then to pay for the growing healthcare needs of an aging population.

I doubt many Americans will be happy about the upcoming changes. Like it or lump it, I say.

No comments:

Post a Comment