One final graphy post for today. The set contains some slightly encouraging news about debt, but very discouraging news about assets.

Musings on Peak Oil and other issues from the Green Mountain State

One final graphy post for today. The set contains some slightly encouraging news about debt, but very discouraging news about assets.

Another belated post full of graphy goodness.

I'm a wee bit behind in posting this, but nonetheless here is the latest debt data.

Positive second derivative! Ok, I didn't check that, but at least for Ford and GM the rate of decline seems to be lessening. Toyota, however, got hammered again.

Unfortunately, I am now known across the blogosphere for producing really bad graphs.

Maybe I should work on that.

I finally got around to reading the huge profile of Geithner in the NYT. It's discouraging. We cannot restore the financial system to its 2007 or 2005 state; it needs a complete overhaul and a new outlook. And now I am quite confident reform efforts will amount to squat.

Maybe we'll see better results on health care.

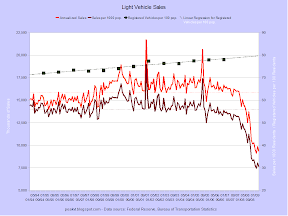

It looks like auto sales have found a floor between 9 million and 10 million SAAR. Now the question is what will become the new normal. 12 million? 15 million? 10 million? I think we'll see 10 million this year, 12 million in 2011, and 14-15 million for a few years after that. Recently built cars (after 1995 or so) last longer and sales from 1999 to 2007 were artificially high due to the internet and then the credit bubbles. That means there is a glut of "car capacity" in the country.

My prediction about Chrysler has been right-ish so far (my timing was off). For the workers' and retirees' sake I hope Fiat succeeds at leading the new venture. But despite Marchione's record, I am not optimistic. And there has been no news about whether the bankruptcy period will be short, which it needs to be.