(Final draft, but I might update it if I learn more.)

A few posts back I asserted that the Fed would be "printing" now that the Federal Funds interest rate has hit the zero bound. It turns out that's not really true. This excellent post explains how the Fed works and what it has been doing lately. I'd like to be able to improve on the post, but it's too good. So, what follows is mostly a restatement in my own words, in order to clarify the situation in my own mind, with some pictures added to help me along.

First, we should back up a bit. For a number of reasons, most sovereign countries issue their own currency, which is "legal tender" with their borders. The Eurozone countries are exceptions to this practice, and various other countries - usually small or poor - have adopted foreign currencies as their own because local political leaders realize the local governments are hopeless. In better-governed countries the local governments have assigned the right to create money to a single, independent authority. Generically, this entity is called a central bank. In the Eurozone, this bank is a trans-national institution, which has pluses and minus. The Federal Reserve System is the most prominent example of this type of institution. A responsible central bank, like regular banks, keeps its balance sheet balanced. It also tries be predictable, if not entirely transparent. And to keep inflation in check, it has to be very careful about exercising it's power to create money.

(I apologize for the lousy color schemes on the graphs below. My software picks them by default and I haven't gotten around to changing the colors in this set - it's a very tedious process.)

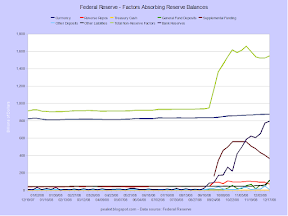

Here we can see the Fed being predictable - until it isn't. The lines are very smooth and the slope doesn't really change until mid-September of 2008. That's when Lehman was allowed to fail and the credit markets blew up.

Here we can see the Fed being predictable - until it isn't. The lines are very smooth and the slope doesn't really change until mid-September of 2008. That's when Lehman was allowed to fail and the credit markets blew up.

The left side of the Fed's balance sheet is where the alphabet soup of purchasing programs shows up. The explosion of liabilities on right side of the sheet seen above was initiated in order to hoover up bad assets from the credit markets and plop them on the left side.

The left side of the Fed's balance sheet is where the alphabet soup of purchasing programs shows up. The explosion of liabilities on right side of the sheet seen above was initiated in order to hoover up bad assets from the credit markets and plop them on the left side.

Zooming in on the past year and eliminating the total liabilities line highlights how completely unprecedented recent developments are.

Zooming in on the past year and eliminating the total liabilities line highlights how completely unprecedented recent developments are.

The asset side of the balance sheet is operating in uncharted territory as well.

The asset side of the balance sheet is operating in uncharted territory as well.

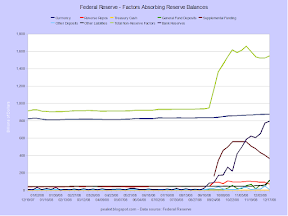

Here's a stacked view of liabilities.

Here's a stacked view of liabilities.

And a stacked view of assets.

And a stacked view of assets.

A composition breakdown of liabilities shows the rapid growth of non-currency items.

A composition breakdown of liabilities shows the rapid growth of non-currency items.

And finally, the breakdown of assets shows the rapid fall of Treasuries as the primary holding.

And finally, the breakdown of assets shows the rapid fall of Treasuries as the primary holding.

As you may have noticed, I have reversed the normal pattern of listing assets before liabilities. That's because the Fed really has been trying to acquire cash (liabilities) before it acquires stuff (assets). Which is to say that the Fed is NOT "printing" - at this point. All the money it is pumping into the economy by buying up assets (trading cash for stuff) is being drained on the other side by taking on liabilities (trading stuff for cash, or sucking in cash.) The balance has been perfect for the past 6 months to two decimal places - though there are small fudge factors deep in the numbers on both sides.

The other thing you may have noticed is that currency in circulation is considered a liability. It is, and it's a non-interest-bearing one. When the Fed adds cash to the economy, it buys an equal amount of stuff (assets). Looking at it the other way, the regional Federal Reserve branches have to buy cash, which they need because people want to conduct transactions. And they need more and more of it because in a growing economy people are conducting more or more valuable transactions every day. If the Fed gave away cash for free, the regional banks would request what they needed and a whole lot more, and cash would become worthless overnight. Instead, the Fed makes the regional branches cough up something of value, which they originally got from various commercial banks in return for the last round of cash. And on down the line. Thus the Fed acquires a pile of interest-bearing assets (somebody else's liabilities), and uses the income stream from the pile to fund its operations. The net of interest minus operating costs is sent to the Treasury.

But wait, you say, don't the Fed's assets consist mostly of Treasuries? (Pay attention here because it's going to get weird.) Yes, it does. And thus, when the Fed buys Treasuries, it takes most of the government's interest rate exposure out of the public's hands, with only the cost of the Fed's operations still flowing out into the economy. For all intents and purposes, the debt disappears because the Fed hands out non-interest-bearing debt in the form of cash when it gets the Treasuries. So what's the point of having the Federal Reserve if the Treasury is essentially paying itself for it's own debts? Well, we want the Fed to be independent in its operations, not be subjected to the immediate whims of politicians. A very extreme example of the results of non-independent monetary policy can be seen in Zimbabwe. The Fed, in contrast, is charged with maintaining stable prices (and full employment, but that is another discussion) and politicians have no easy way of changing that mandate. This makes it unlikely that the institution will print gobs of money to pay off the federal government's debt. And as bad as the federal government's balance sheet is, hyperinflation is a lot worse.

Theoretically, the Fed could sell off all of it's Treasuries and try to suck back all the dollars it has sent out over the years. In the past it has done this occasionally on a very small scale when it thinks the money supply is growing too fast. But lately it has been doing something else. It has been selling Treasuries for cash, but then immediately shipping the cash back out for a different set of interest-bearing assets. The specifics of these new assets are largely unknown, but the charts above show the broad classes. It also has acquired cash from two new sources. One is the Treasury, which sold off a pile of brand new Treasuries specifically for the purpose of putting the money in its checking account at the Fed. The Fed used this cash to buy new assets as well. Finally, commercial banks have put a huge amount of "excess" reserves into their accounts at the Fed (at the regional branches, to be precise). Once again the Fed has been using the new cash to buy assets.

So what's the problem if everything balances out? It turns out there are three problems. First, it re-exposes the federal government to principle and interest liabilities that were once hidden in the Fed. With the public now owning the Treasuries that once were at the Fed, the interest payments no longer magically reappear in the pocket they just came out of. Since these Treasuries are mostly short-term issues, there is also the danger of not being able to roll them all over. Second, the Fed is paying interest on the excess reserves. A note on these reserves. The reason the banks have all this extra dough is they aren't lending. Remember the credit crisis? Here is proof that is quite real. The Fed has basically said: okay, since you guys won't lend, I'll borrow your cash and lend in specific credit markets that you pansies are too chicken to enter, and I'll make sure you lend me the extras by paying interest on what you deposit. Normally banks only have between $5B and $30B of reserves at the Fed. Now it's around $800B, and the annual interest on that will be at least $2B. While that amount is a lot less than the $15B the Fed is on track (or was, as of Dec 1) to return the the Treasury this fiscal year, but it's still a lot of money. Which brings us to the final problem.

The third problem is only a potential one at this point. As I said above, we don't know exactly what the Fed has hoovered up, so we don't know if the assets will perform, meaning provide a stream of payments of interest and, possibly, principal. The Fed might have bought junk at a discount. The Fed might have bought junk at face value. The Fed might have been choosy and selected only the best assets. The Fed might have driven a hard bargin and bought great assets at fire-sale prices. We don't know. If the assets perform poorly, the Fed will have a hard time meeting its interest obligations. If they blow up, perhaps because the issuer goes bankrupt, the Fed will have a real problem. The interest and principle would disappear, but the corresponding liability would still exist. But since the Fed is, you know, the Fed, it can't short any of its creditors. Fortunately, about one-third of the new liabilities are deposits by the Treasury, and it's highly unlikely the new assets would decline in value so much that new borrowing by the Treasury would be needed. Any gap between the assets sold and the liabilities paid off would just end up as another liability of the American taxpayer.

So, by looking at both sides of the Fed's balance sheet, it seems pretty clear that the Fed is not doing Zimbabwe-style printing. All the "innovations" are being "sterilized", meaning there is no new currency being issued. Right?

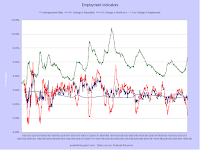

Well, maybe not. The M0 (currency) line shows a definite uptick for that measure. M1 (M0 plus checking accounts) is definitely way up. But M2 (M1 plus savings accounts, small time deposits, and money market deposit accounts) growth isn't as high, and while the MZM (M2 minus time deposits plus all other money market accounts) was high earlier in the year, it's growth has come down.

Well, maybe not. The M0 (currency) line shows a definite uptick for that measure. M1 (M0 plus checking accounts) is definitely way up. But M2 (M1 plus savings accounts, small time deposits, and money market deposit accounts) growth isn't as high, and while the MZM (M2 minus time deposits plus all other money market accounts) was high earlier in the year, it's growth has come down.

A broader time frame provides some needed context. M1 growth is still notable, but the other measures are growing less fast than they have at various times in the past.

A broader time frame provides some needed context. M1 growth is still notable, but the other measures are growing less fast than they have at various times in the past.

Zooming out the the full extent of the data shows some freaky action in the MZM measure during the early 1980s.

Zooming out the the full extent of the data shows some freaky action in the MZM measure during the early 1980s.

So why is M0 up? Because the Fed hasn't stopped issue currency, and is actually doing so a little faster than before September. Over the time period for which I have both sets of data, the two measures track identically. That's expected. In light of this, inspecting the first and third graphs does reveal a slight upward movement of the currency lines near the end of the time frame. But the last graph shows that the M0 growth rate is not unusual - so far.

So why is M0 up? Because the Fed hasn't stopped issue currency, and is actually doing so a little faster than before September. Over the time period for which I have both sets of data, the two measures track identically. That's expected. In light of this, inspecting the first and third graphs does reveal a slight upward movement of the currency lines near the end of the time frame. But the last graph shows that the M0 growth rate is not unusual - so far.

Frankly, I think it's too soon to decide if there is a new trend in the money supply. And I also think that it is possible that some of the growth is from people switching their preferences for financial assets towards what they perceive as safer instruments, such as bank deposits and physical cash. The economy is certainly not growing, but yet the demand is still there. So out the door the dollars go. Whether the Fed sucks extra dollars back in when the economy starts to grow or lets them float about and create some inflation remains to be seen.